External Analysis: Other Frame Works

Other frame works

One of the most important reasons for analyzing the external environment is to anticipate future trends and identify potential challenges or opportunities.

Of course, it’s not feasible to examine every aspect of the external environment. However, frameworks like Porter’s Five Forces, along with additional tools, can be helpful in guiding strategic analysis.

Here are three additional frameworks commonly used for analyzing the external environment:

- Industry Life Cycle

- Complements

- PESTEL

Industry life Cycle

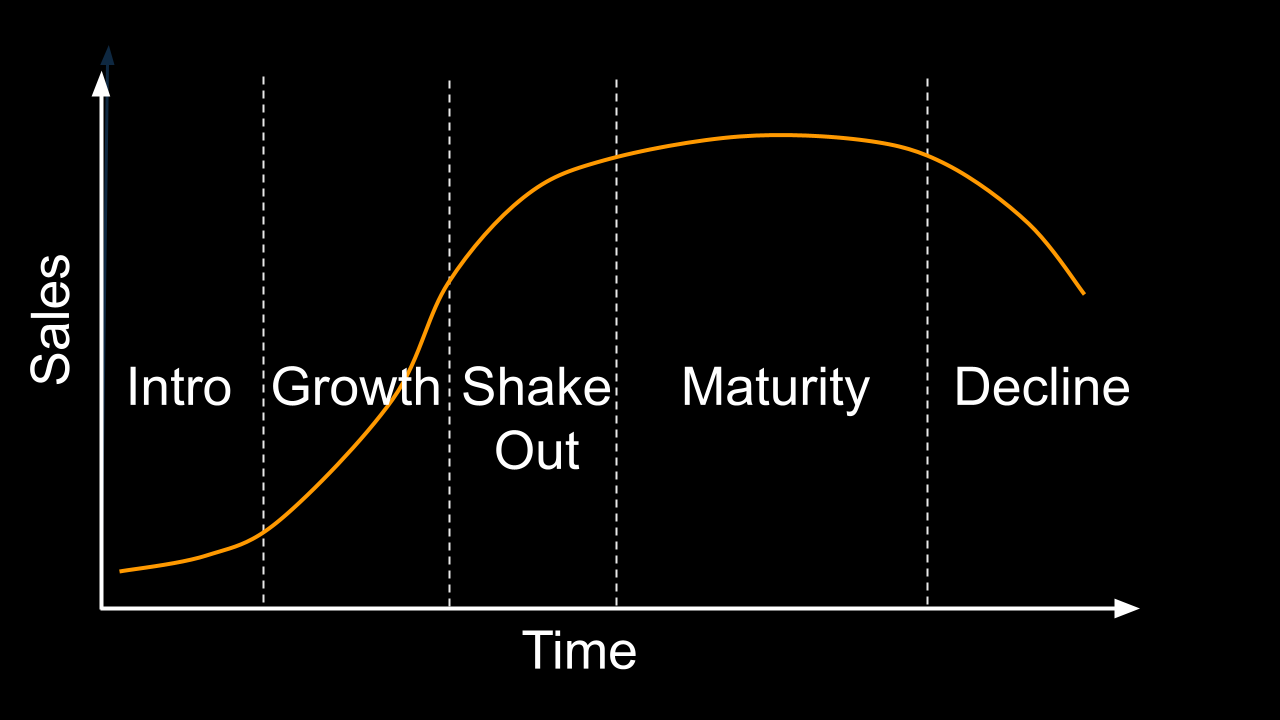

Most industries go through a journey from emergence to eventual decline, known as the Industry Life Cycle. Understanding this cycle helps businesses make informed strategic decisions, anticipate major shifts, and position themselves for sustainable success.

To make the most of this framework, consider the following key questions:

- What is the current stage of the industry’s evolution?

- How long is this stage expected to last?

- Is the firm ready for the next stage?

The Industry Life Cycle outlines how industries evolve over time, primarily by tracking the rise and fall in the number of firms.

Let’s dive into each stage.

Stage 1: Introduction (The Startup Phase)

This is the birth of an industry, marked by a groundbreaking innovation or a new technology. Think of the early days of personal computers or, more recently, virtual reality and generative AI.

- Characteristics:

- High Risk, High Investment: Companies in this phase are often startups with no guaranteed success. They spend heavily on research and development (R&D) and on educating a skeptical market.

- Few Competitors: The market is new, so there are only a handful of pioneering firms.

- Slow Growth: Sales are initially slow as early adopters and innovators are the only customers.

- No Standardized Design: Products are often unique and non-standardized.

- Example: The virtual reality (VR) industry in the early 2010s, with a few pioneering companies introducing experimental headsets.

Stage 2: Growth (The Expansion Phase)

Once the new product or service gains market acceptance, the industry enters a period of rapid expansion. Consumers have now understood the value proposition, and demand skyrockets.

- Characteristics:

- Rapid Sales Growth: Demand increases exponentially, and the market expands quickly.

- Increasing Competition: The success attracts new entrants, leading to more competitors.

- Price Reduction: As companies gain economies of scale, prices may begin to fall, making the product more accessible.

- Focus on Market Share: The primary goal for companies is to capture as much market share as possible.

- Example: The electric vehicle (EV) industry is currently in this phase. With government incentives and growing consumer interest, new companies are entering the market to compete with pioneers like Tesla.

Stage 3: Shakeout (The Contraction Phase)

This stage is a turning point where the explosive growth from the previous phase begins to slow down. Competition becomes fierce, and the market can no longer support all the players.

- Characteristics:

- Slowing Growth: The market starts to become saturated, and the sales growth rate decreases.

- Intense Price Wars: Companies resort to aggressive pricing and marketing to attract customers.

- Consolidation: Weaker, less efficient competitors are forced out of the market through bankruptcy or are acquired by larger rivals. The number of players in the industry begins to shrink.

- Example: The early 2000s saw a major shakeout in the dot-com industry. Many internet startups that had thrived during the boom failed once investor funding dried up and competition became a zero-sum game.

Stage 4: Maturity (The Consolidation Phase)

After the shakeout, a few dominant players remain and the industry stabilizes. This is the longest stage of the life cycle.

- Characteristics:

- Stable Demand: The market is now saturated, and demand is driven by replacement purchases rather than new customers.

- High Barriers to Entry: It is very difficult for new companies to enter the market due to the strong brand loyalty and economies of scale of the existing giants.

- Focus on Efficiency and Differentiation: Companies focus on cost reduction, product improvements, and marketing to maintain their market share.

- Example: The soft drink industry, dominated by Coca-Cola and PepsiCo, is a classic example of a mature industry. Companies focus on brand loyalty, new flavors, and efficient distribution to maintain their position.

Stage 5: Decline (The Exit Phase)

In the final stage, the industry experiences a permanent downturn in demand. This is often caused by new technologies, shifts in consumer preferences, or changes in the economic environment.

- Characteristics:

- Decreasing Sales and Profits: Revenue and profit margins consistently shrink.

- Companies Exit: Firms begin to exit the industry through liquidation or by selling off assets.

- Remaining Players: The few remaining firms might focus on a niche market or try to milk the last bit of profit from the industry.

- Example: The film camera industry declined significantly with the rise of digital photography. Similarly, the demand for physical DVDs has plummeted due to streaming services.

Complements

A complement, sometimes referred to as Porter’s Sixth Force, is a product or service that enhances the appeal, utility, or demand of another product when used in combination. It emphasizes opportunities rather than threats.

Real-World Examples of Complements

To understand how complements work in practice, let’s look at some familiar examples:

- E-Readers and E-Books: A Kindle without e-books is just a screen. The true value comes when paired with a vast e-book library.

- Electric Vehicles and Charging Stations: The convenience and adoption of EVs rise with accessible charging networks—like Tesla’s Supercharger infrastructure.

Did you know the electric car was invented over 100 years ago? And even the first person ever recorded for speeding was driving an electric vehicle—in 1899! However, despite this early innovation, the EV industry didn’t grow significantly for a long time. Why? Because essential complements—like charging infrastructure and battery technology—were not yet developed. This underscores the importance of complements: even groundbreaking products may fail to gain traction without the right supporting environment in place.

PESTEL

PESTEL Analysis is a framework used to scan and understand the external macro-environmental factors that may impact an organization. It helps businesses anticipate risks and opportunities by examining six key dimensions:

- Political: Government policies, regulations, and political stability.

- Economic: Interest rates, inflation, economic growth, and employment trends.

- Social: Demographics, cultural trends, and consumer behaviors.

- Technological: Innovations, automation, R&D, and technological change.

- Environmental: Climate change, sustainability practices, and ecological factors.

- Legal: Laws, regulations, and legal environments affecting operations.

By evaluating these factors, firms can better adapt their strategies to the broader environment and make more informed decisions.

others feel stuck in a slow-moving, mature state? The answer often lies in the industry life cycle, a powerful framework that helps us understand the predictable stages of an industry’s evolution.

Just like a product or a living organism, an entire industry is born, grows, matures, and eventually declines. Understanding where an industry is in its life cycle is crucial for business leaders, investors, and anyone trying to make sense of the ever-changing market.

Let’s break down the five key stages of the industry life cycle.

More about industry life cycle