Overview of the Income Statement

An income statement is a powerful tool for measuring a company’s financial health. While the balance sheet is like a photo of a company at a single moment in time, the income statement is more like a video—it shows how a company performed over a period, typically a quarter or a year.

What’s in an Income Statement?

At its core, the income statement answers a simple question: Did the company make a profit? To find that out, it follows a straightforward formula:

Revenue – Expenses = Net Income (or Net Loss)

The Tiered Approach to Profitability

When you see an actual income statement, expenses and profitability are broken down into several levels. This gives us more detailed information. To calculate net income, you have to follow several steps that break down the company’s performance.

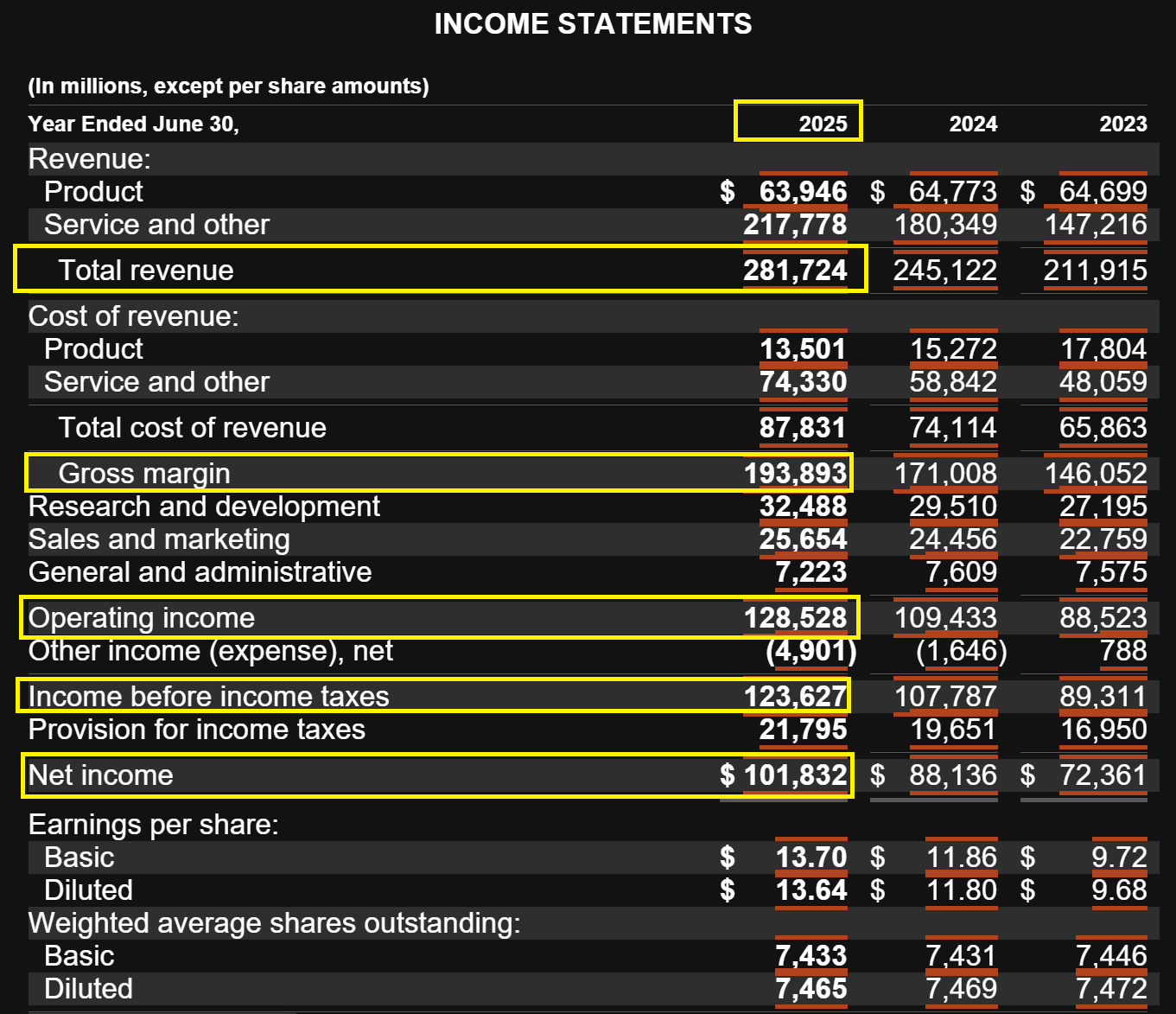

Total Cost of Revenue

This is the direct cost of producing the goods or services that a company sells. For the example provided, the total cost of revenue for 2025 was $87,831 million. By separating this from other expenses, we can calculate Gross Margin.

Gross Margin

This shows the profit a company makes before accounting for any other business expenses. This is useful because it highlights the profitability of the company’s core product or service before other costs. For 2025, the gross margin was $193,893 million. We calculate this by subtracting the total cost of revenue ($87,831 million) from total revenue ($281,724 million).

Operating Income

This shows the profit a company makes from its primary business operations. You calculate it by subtracting all of the company’s operating expenses (like research and development, sales and marketing, and general and administrative costs) from the gross margin. For 2025, the operating income was $128,528 million. You can calculate this as the gross margin ($193,893 million) minus research and development costs ($32,488 million), sales and marketing costs ($25,654 million), and general and administrative costs ($7,223 million).

Other Income – Expense

This section includes income and expenses that are not part of a company’s main business operations. This could be interest earned on investments or a loss from selling a piece of property. The statement lists it separately because it isn’t part of the core business performance. For 2025, the company had a non-operating expense of $4,901 million.

Income before income taxes

This is the company’s profit before it pays taxes. You calculate it by adding operating income (128,528million) and other income & expense(-4,901 million). For 2025, this amount was $123,627 million.

Net Income

Finally, you get to Net Income after accounting for all revenues, all expenses (including taxes and other non-operating items). It’s the ultimate measure of a company’s profitability. For 2025, the net income was $101,832 million. We calculate this by adding the operating income (128,528million) to other income & expense(-4,901 million) and then subtracting the provision for income taxes ($21,795 million).

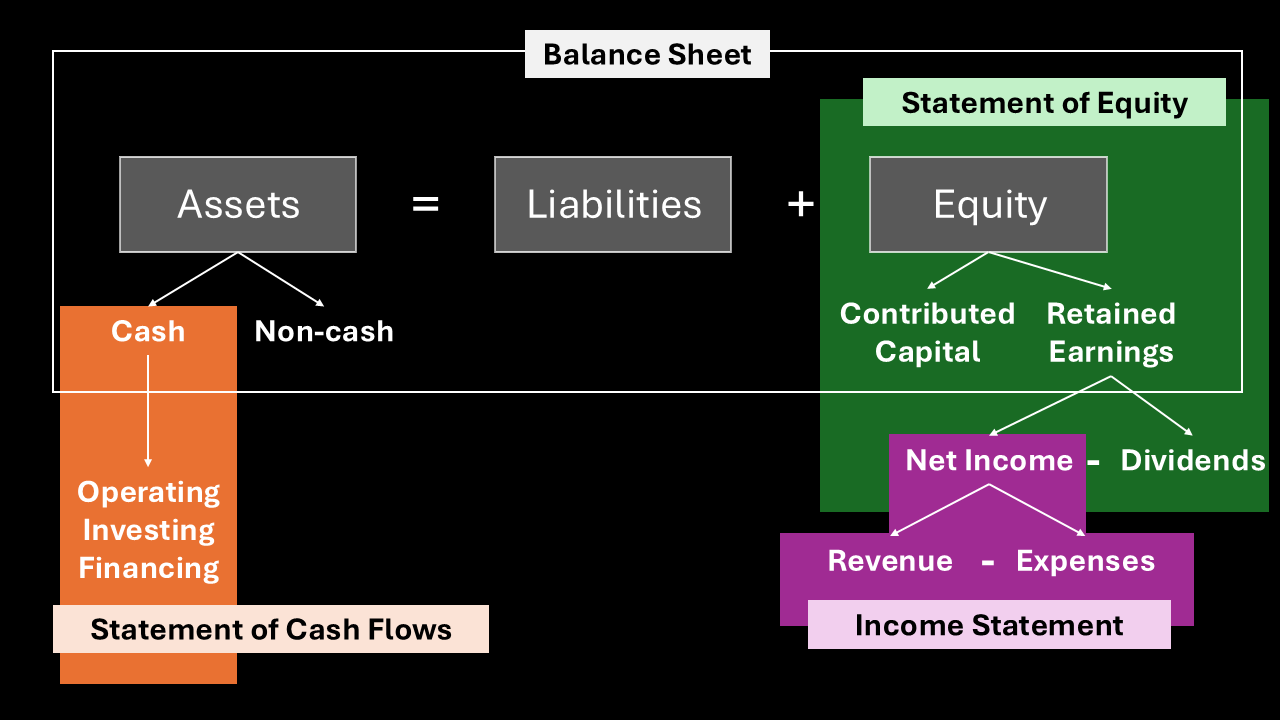

Connecting the Financial Dots

The income statement doesn’t stand alone. It’s directly connected to other financial statements. As the diagram shows, a company’s Net Income is a critical component that flows into the Statement of Equity.

The Statement of Equity tracks changes in the owners’ stake in the company. A company can use its net income in two main ways:

- Retained Earnings: It can keep the profits to reinvest in the business, which increases equity.

- Dividends: It can pay out the profits to shareholders, which reduces retained earnings.

This connection shows how a company’s profitability (from the income statement) directly impacts the value of the owners’ stake (on the statement of equity).

Why It Matters

For investors, managers, and analysts, the income statement is a powerful tool. It helps them understand a company’s operating performance, identify trends in revenue and expenses, and assess its overall profitability. By looking at a series of income statements over time, you can get a clear picture of whether a company is growing, shrinking, or staying the course.