Understanding Financial Transactions and Adjusting Entries

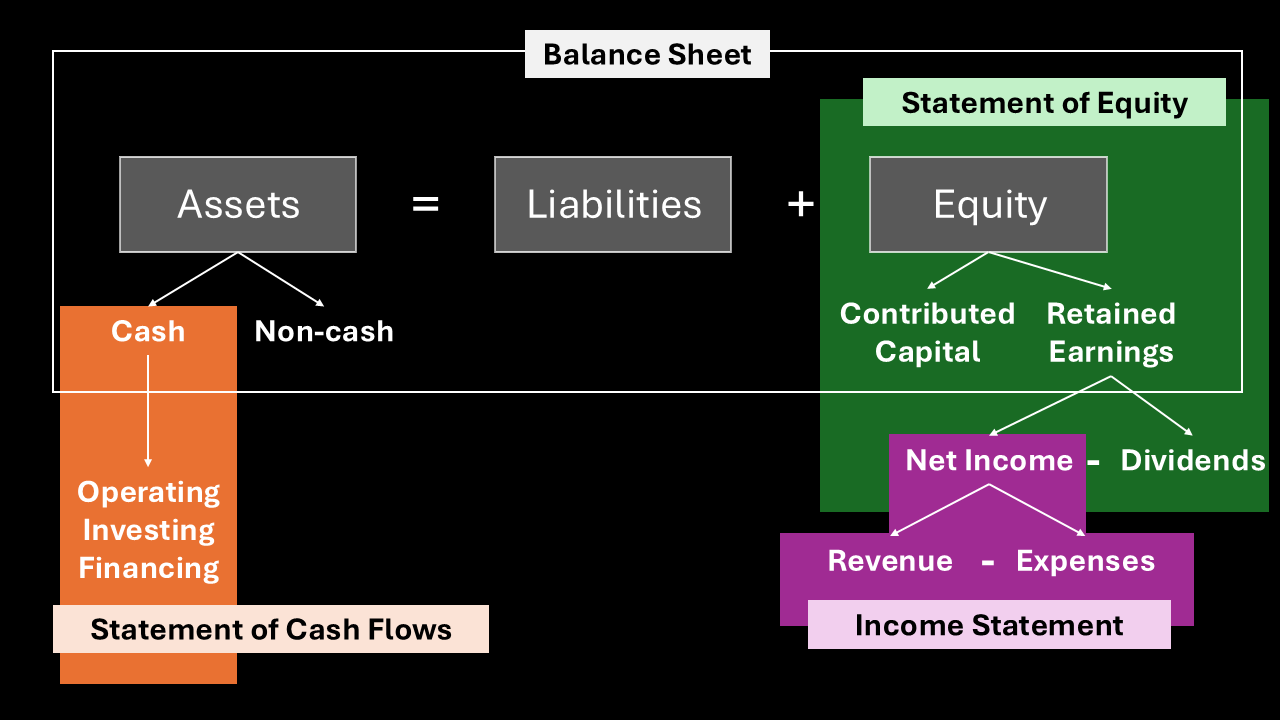

In this post, we’re going to explore accounting adjustments. These accounting adjustments affect four main account types:

- Prepaid expenses: These are expenses paid in advance, such as prepaid rent or insurance.

- Unearned revenues: This is cash received for goods or services that have not yet been delivered or performed. It’s a liability until the work is done.

- Accrued expenses: These are expenses that have been incurred but not yet paid or recorded, such as wages or interest.

- Accrued revenues: This is revenue that has been earned but for which cash has not yet been received.

Now, let’s see how these concepts apply to our example.

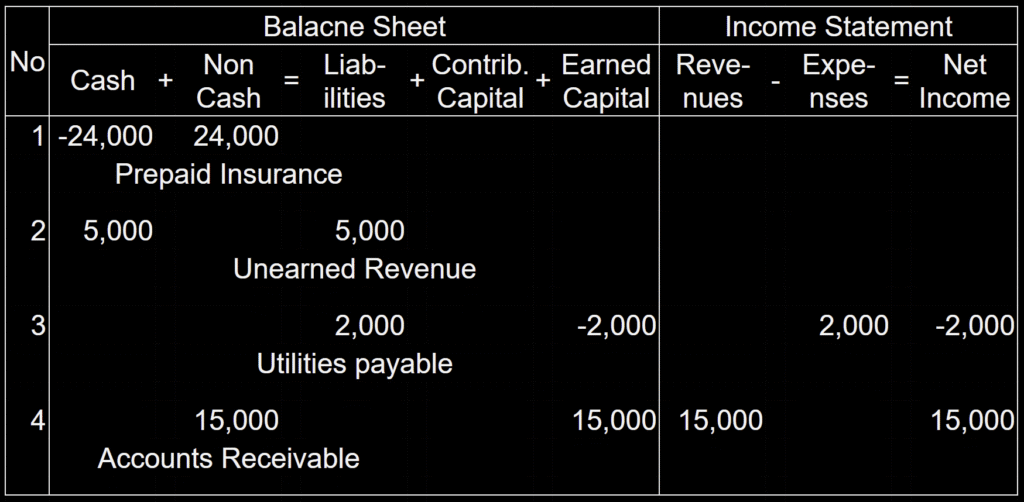

Part 1: Initial Transactions (March)

Imagine a small company, “Sunny Solar,” that sells and installs solar panels. Here are some of the transactions that might happen in March:

- Transaction a: Prepaid Insurance Sunny Solar pays $24,000 for a one-year insurance policy in advance. This is an asset for the company.

- Balance Sheet:

- Cash Asset: -$24,000

- Prepaid Insurance (Noncash Asset): +$24,000

- Balance Sheet:

- Transaction b: Customer Prepayment A customer pays Sunny Solar $5,000 in advance for a solar panel installation that will happen next month.

- Balance Sheet:

- Cash Asset: +$5,000

- Unearned Revenue (Liability): +$5,000

- Balance Sheet:

- Transaction c: Purchase on Credit Sunny Solar receives a bill for $2,000 for utility expenses, but they haven’t paid it yet.

- Balance Sheet:

- Utilities Payable (Liability): +$2,000

- Income Statement:

- Expenses: +$2,000

- Net Income: -$2,000

- Balance Sheet:

- Transaction d: Revenue on Account Sunny Solar completes a project for a client, billing them $15,000. The client has not paid yet.

- Balance Sheet:

- Accounts Receivable (Noncash Asset): +$15,000

- Income Statement:

- Revenue: +$15,000

- Net Income: +$15,000

- Balance Sheet:

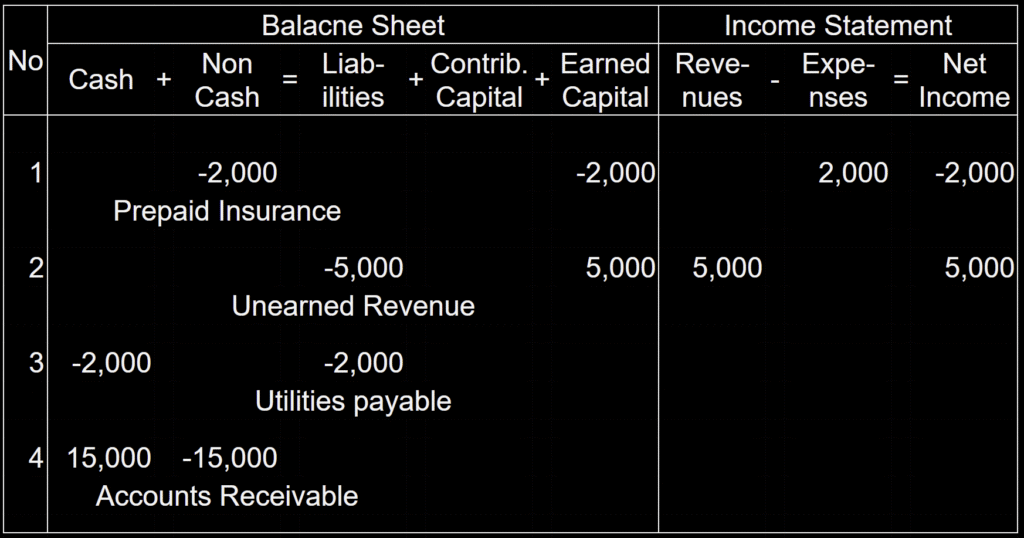

Part 2: Adjusting Entries (End of March)

At the end of March, Sunny Solar needs to “adjust” some accounts to accurately reflect what happened during the month.

- Adjusting Entry A: Using Up Insurance One month of the prepaid insurance has now expired. Sunny Solar needs to record this as an expense.

- Balance Sheet:

- Prepaid Insurance (Noncash Asset): -$2,000 ($24,000 / 12 months)

- Retained Earnings (Capital): -$2,000

- Income Statement:

- Expenses: +$2,000

- Net Income: -$2,000

- Balance Sheet:

- Adjusting Entry B: Earning Revenue Sunny Solar completes the installation for the customer who paid in advance. Now they have “earned” the revenue.

- Balance Sheet:

- Unearned Revenue (Liability): -$5,000

- Retained Earnings (Capital): +$5,000

- Income Statement:

- Revenue: +$5,000

- Net Income: +$5,000

- Balance Sheet:

- Adjusting Entry C: Paying the Bill Sunny Solar pays the $2,000 utility bill they received earlier in the month.

- Balance Sheet:

- Cash Asset: -$2,000

- Utilities Payable (Liability): -$2,000

- Balance Sheet:

- Adjusting Entry D: Collecting Cash The client who was billed earlier for $15,000 now pays Sunny Solar.

- Balance Sheet:

- Cash Asset: +$15,000

- Accounts Receivable (Noncash Asset): -$15,000

- Balance Sheet:

By recording both initial transactions and these crucial adjusting entries, Sunny Solar can generate accurate financial statements that show a true picture of the company’s financial health.