The Accounting Cycle Explained: From Transactions to Financial Statements

In the previous post, we studied depreciation, and now let’s write financial statements on hand, since practice directly is one of effective way to understand. Let’s continue this problem with the task of preparing the three main financial statements for The Gadget Store, LLC based on the unadjusted, pre-closing, and post-closing trial balances we’ve analyzed.

Accounting Case Study: The Gadget Store, LLC

- The Gadget Store, LLC was formed on February 1, 2025, with the investment of $75,000 in cash by the owners.

- Obtained a bank loan and received the proceeds of $50,000 on February 2. The cash will be used for operations.

- Purchased equipment for $30,000 cash on February 2.

- Acquired a building at a cost of $100,000. It was financed by making a $25,000 down-payment and obtaining a mortgage for the balance. The transaction occurred on February 2.

- On February 4, purchased merchandise inventory (i.e., gadgets) at a cost of $18,000 by paying $7,000 cash and receiving short-term credit for the remainder from the supplier.

- Sales of gadgets for the month of February, 2025, totaled $15,000. All sales were for cash. The gadgets cost $6,500.

- For all of February, total employee wages and salaries earned/paid were $5,000.

a) As of the end of February, one month’s depreciation on the equipment and building was recognized – $500 for the building and $200 for the equipment.

b) $600 interest expense on the note and mortgage was due but not paid as of February 28. Assume that the principal amounts ($50,000 + $75,000) of the note and mortgage remain unchanged.

c) Impairs inventory by $100, using the account “Loss on impairment.”

A Note on Transaction Types

The numbered items are regular transactions that happen throughout the month. In contrast, the lettered items are adjusting entries that we make only at the very end of the month to update accounts for things like depreciation and accrued expenses. Therefore, the purpose of these entries is to ensure the financial statements are accurate.

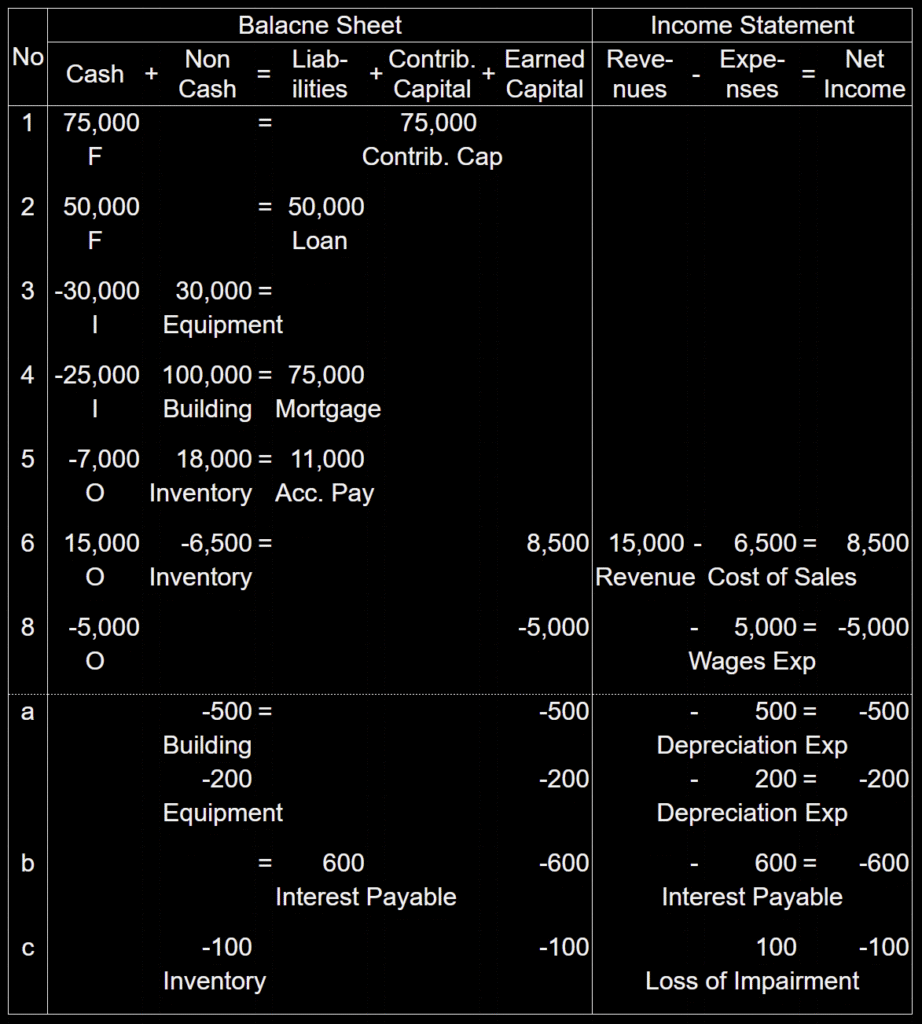

Step 1: Transaction Analysis using FSET

This table is the Transaction Analysis Worksheet, the first step in solving a financial accounting problem. We use this tool to apply the Financial Statement Effects Template (FSET), which shows how each business transaction and adjusting entry affects the accounting equation

Assets = Liabilities + Equity

and the income statement.

Revenues − Expenses = Net Income

By using this table, we can ensure that every entry is properly balanced before moving on to the next steps of the accounting cycle.

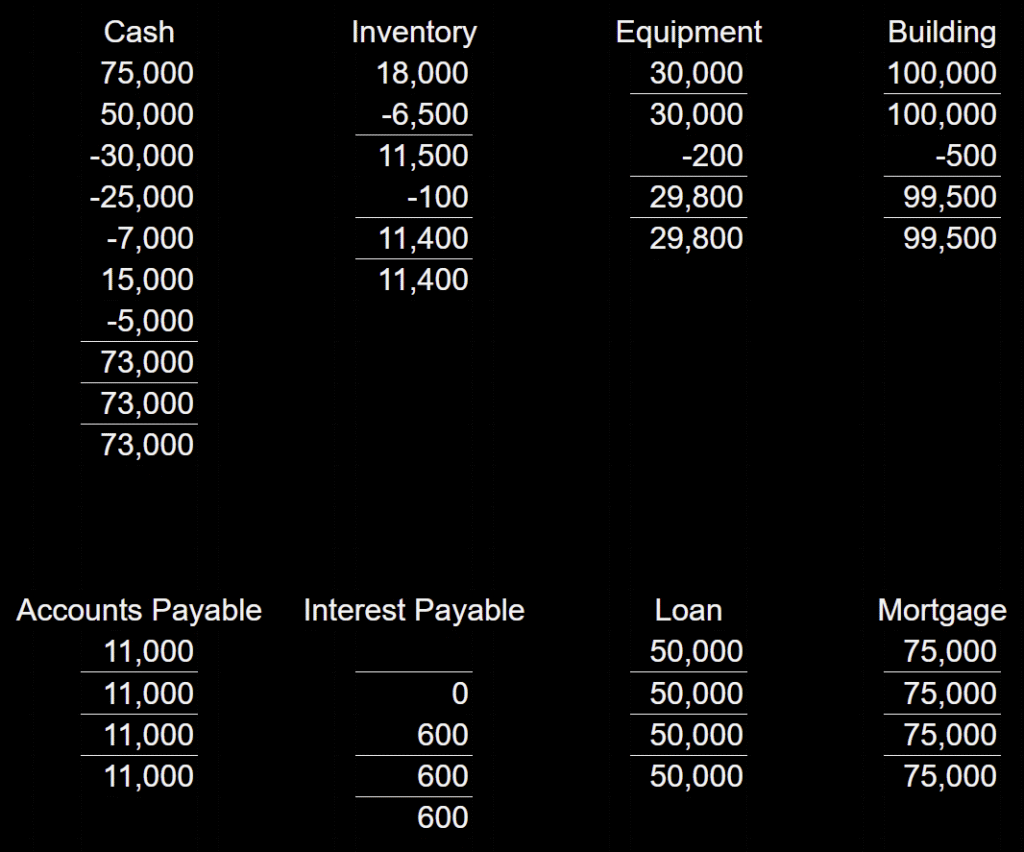

Step 2: The Accounting Ledger

After we analyze the transactions, we summarize them in the accounting ledger. To do this, we post each transaction to its specific account (e.g., Cash, Inventory, Loans) to create a running balance for each. The ledger, therefore, effectively organizes all the individual changes from the FSET table into a single summary for each account. Consequently, this allows us to easily find the final balance for every account, which is the exact information we will need for the next step: creating the trial balance.

Note on Underlines: Each horizontal line in the ledger represents a key calculation point:

- The first underline shows the balance after all the regular, daily transactions (1-7). This is the value that we use for the unadjusted trial balance.

- The second underline shows the balance after we apply the adjusting entries (a-c). This is the value that we use for the pre-closing trial balance.

- The third underline shows the final balance after we close the temporary accounts, which we use for the post-closing trial balance.

- We do this by resetting the values of the income statement accounts (e.g., Sales, Cost of Sales, etc.) to zero and reflecting their net effect in the retained earnings account.

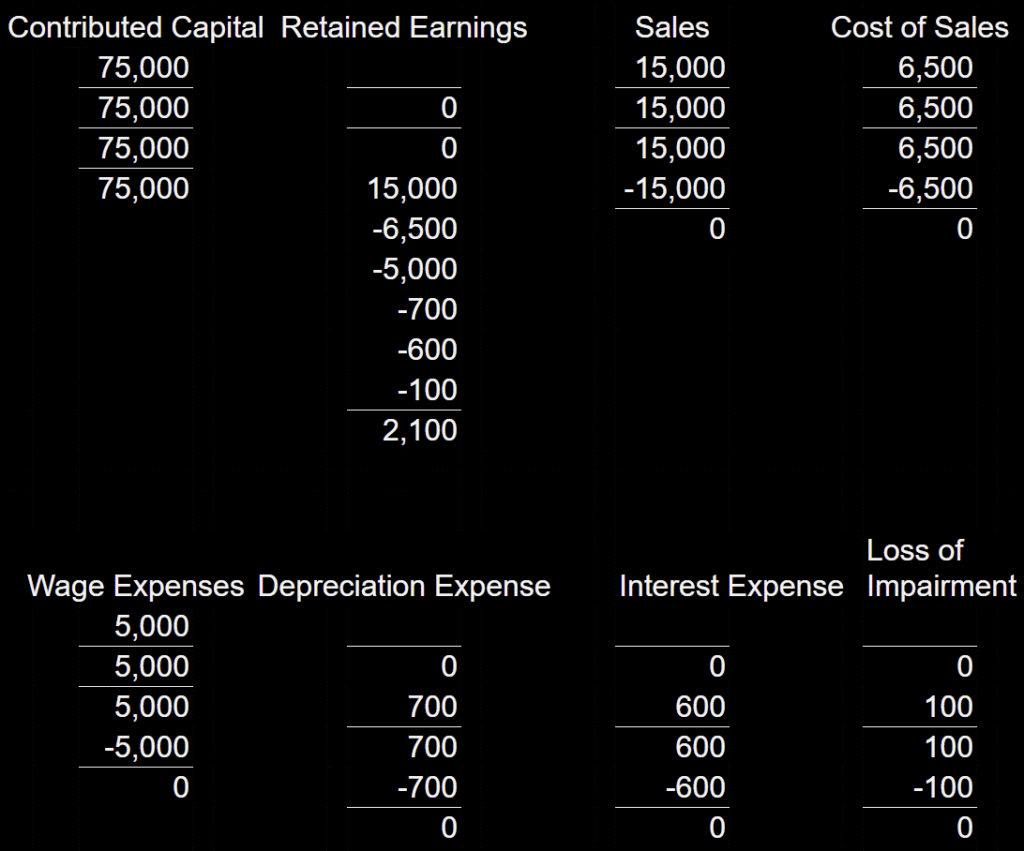

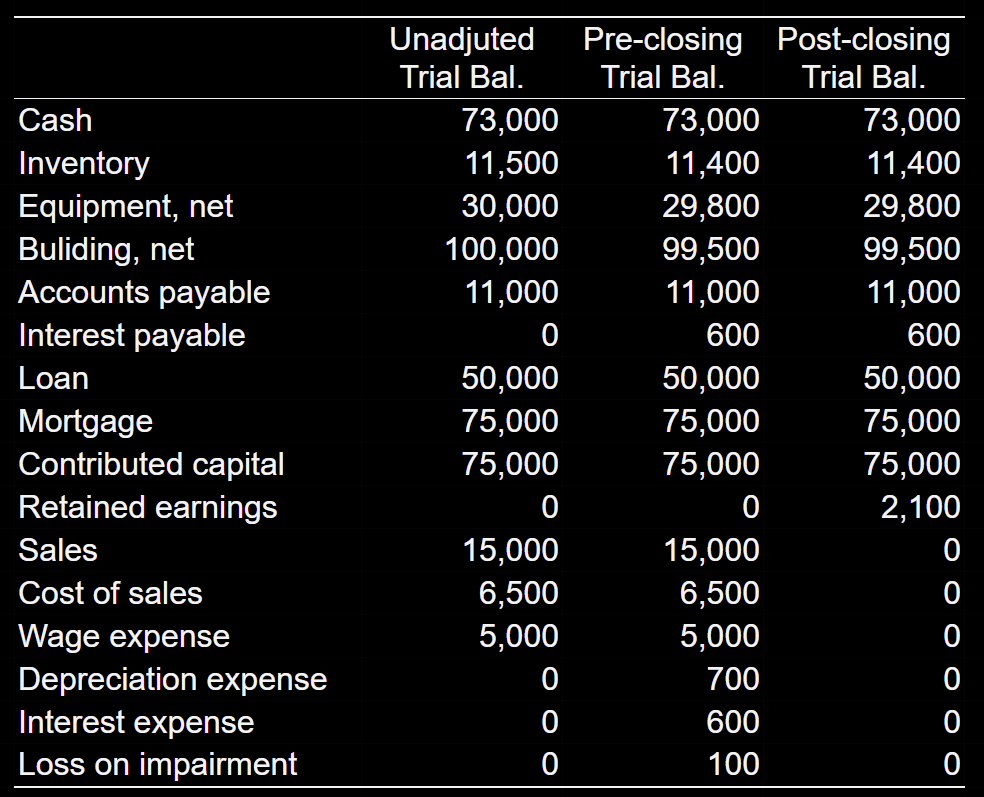

Step 3: Trial Balance

The trial balance is a critical checkpoint in the accounting process. After we post all transactions and adjusting entries to the ledger accounts, we prepare the trial balance to verify that the total of all debit balances equals the total of all credit balances. This ensures we follow the fundamental principle of double-entry accounting. In this specific problem, we prepare three trial balances: the unadjusted, the pre-closing, and the post-closing, to show the effect of the adjusting and closing entries.

- Unadjusted Trial Balance: We prepare this after we record all daily transactions but before we make any adjusting entries. It shows the initial balances.

- Pre-closing Trial Balance: We prepare this after we post all adjusting entries. It includes the updated balances for all accounts, including temporary accounts like Sales and Expenses.

- Post-closing Trial Balance: This is the final trial balance that we prepare after we close all temporary accounts. It only includes the permanent accounts (assets, liabilities, and equity), which we will carry over to the next accounting period. We reset the balances from all temporary accounts to zero and transfer them to the retained earnings account.

Step 4: The Financial Statements

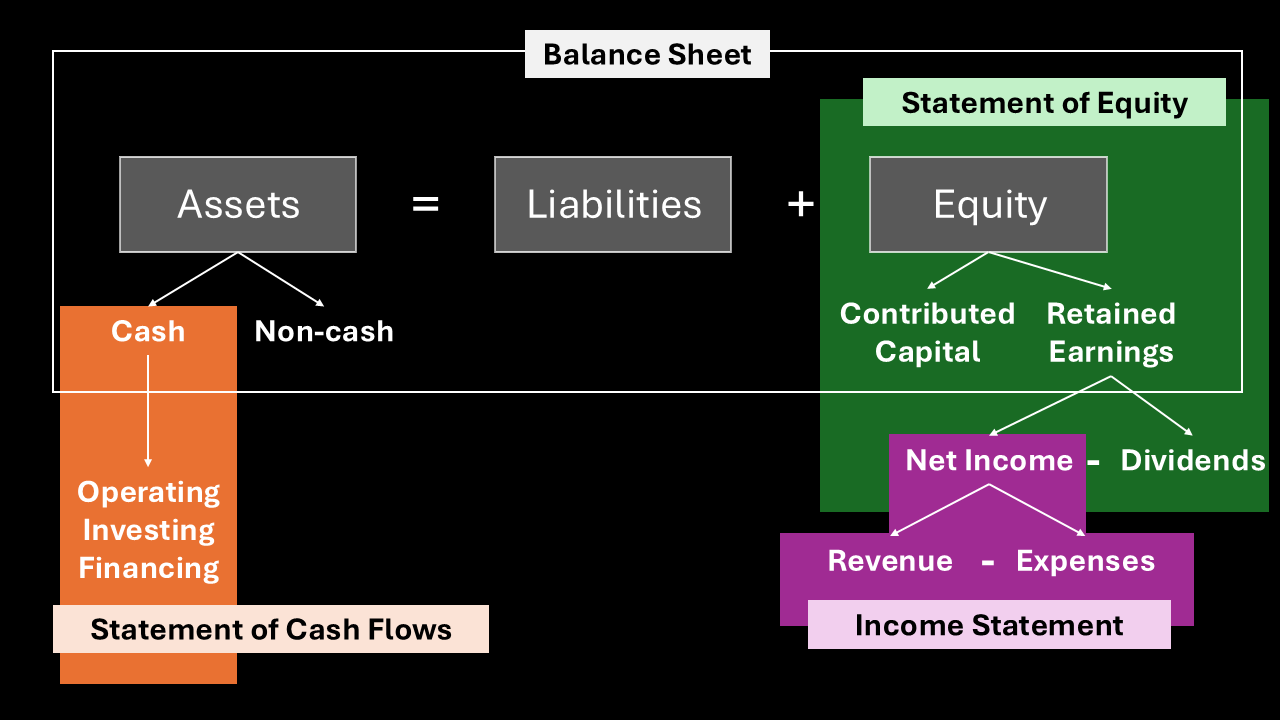

The final step in the accounting process is to use the trial balances to prepare the three main financial statements. These statements, in short, tell a story about a company’s financial health, performance, and cash movements.

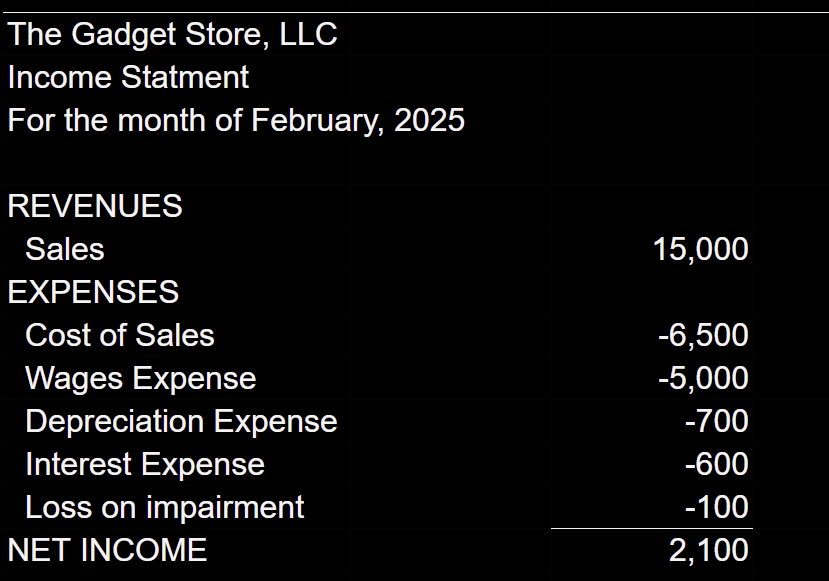

- The Income Statement shows the company’s profitability over a period of time by matching revenues and expenses to calculate Net Income.

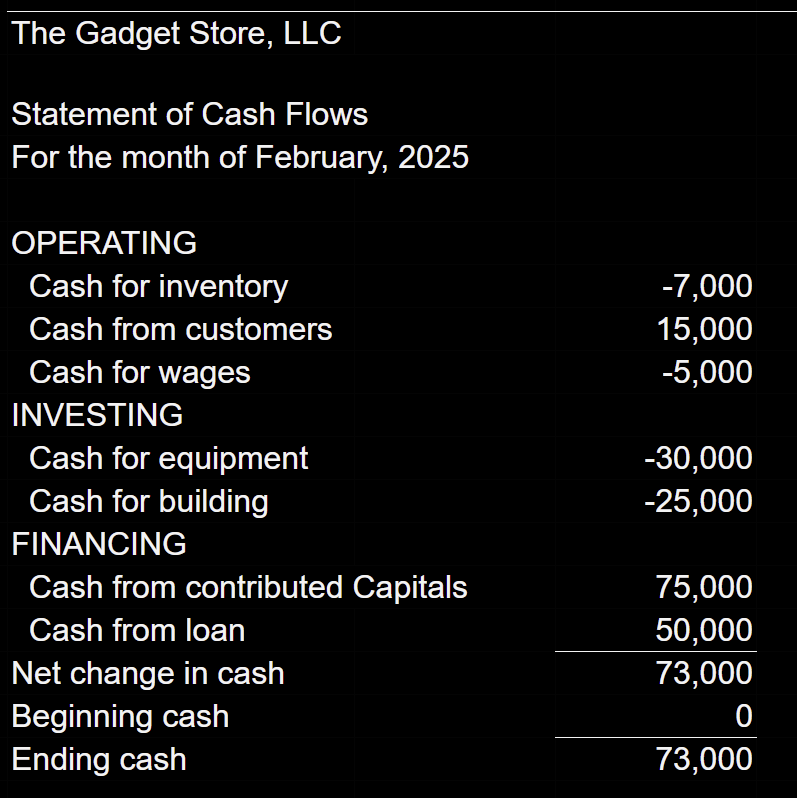

- The Statement of Cash Flows explains the changes in the cash balance from one period to the next by categorizing cash flows into three main activities: operating, investing, and financing.

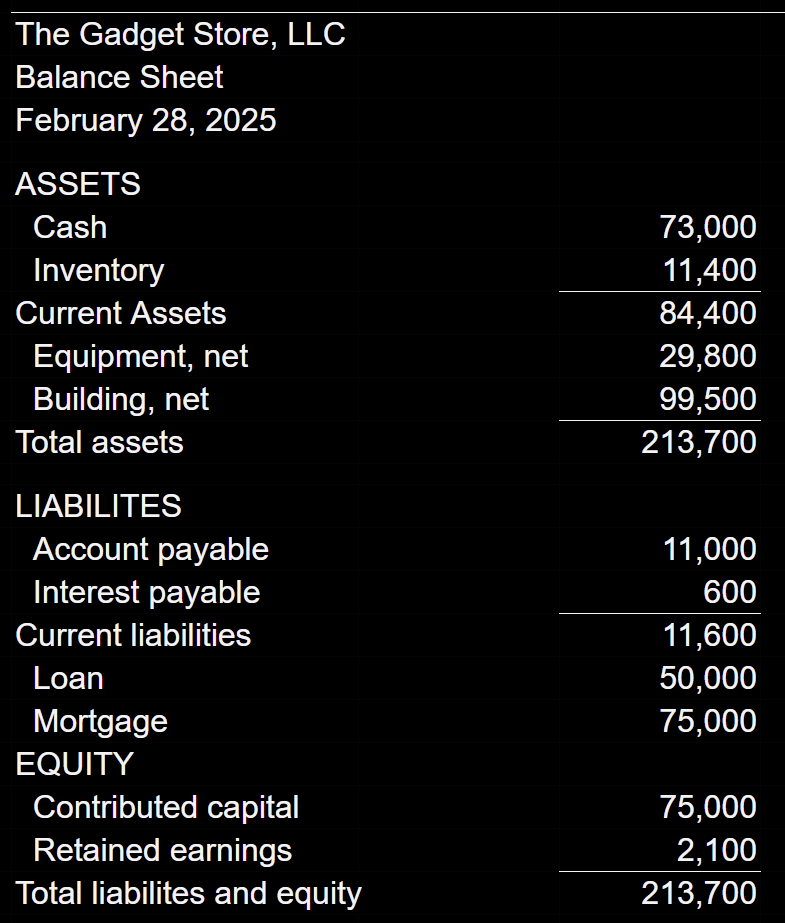

- The Balance Sheet provides a snapshot of the company’s financial position at a single point in time, summarizing its assets, liabilities, and owner’s equity.