Unlocking Profitability: The Power of DuPont Analysis

Ever wonder what really drives a company’s profit? The simple numbers on an income statement only scratch the surface. That’s where DuPont analysis comes in. It’s a powerful accounting technique that breaks down Return on Equity (ROE) into three key components, helping you discover the true causes of a company’s success.

ROE is the most common profitability metric. It shows how much profit a company generates for every dollar of shareholder equity. The formula is:

$$ROE = \frac{\text{Net Income}}{\text{Total Equity}}$$

DuPont analysis goes deeper. It reveals whether a company’s success comes from its operational efficiency, asset utilization, or financial structure.

The Three Core Components of DuPont Analysis

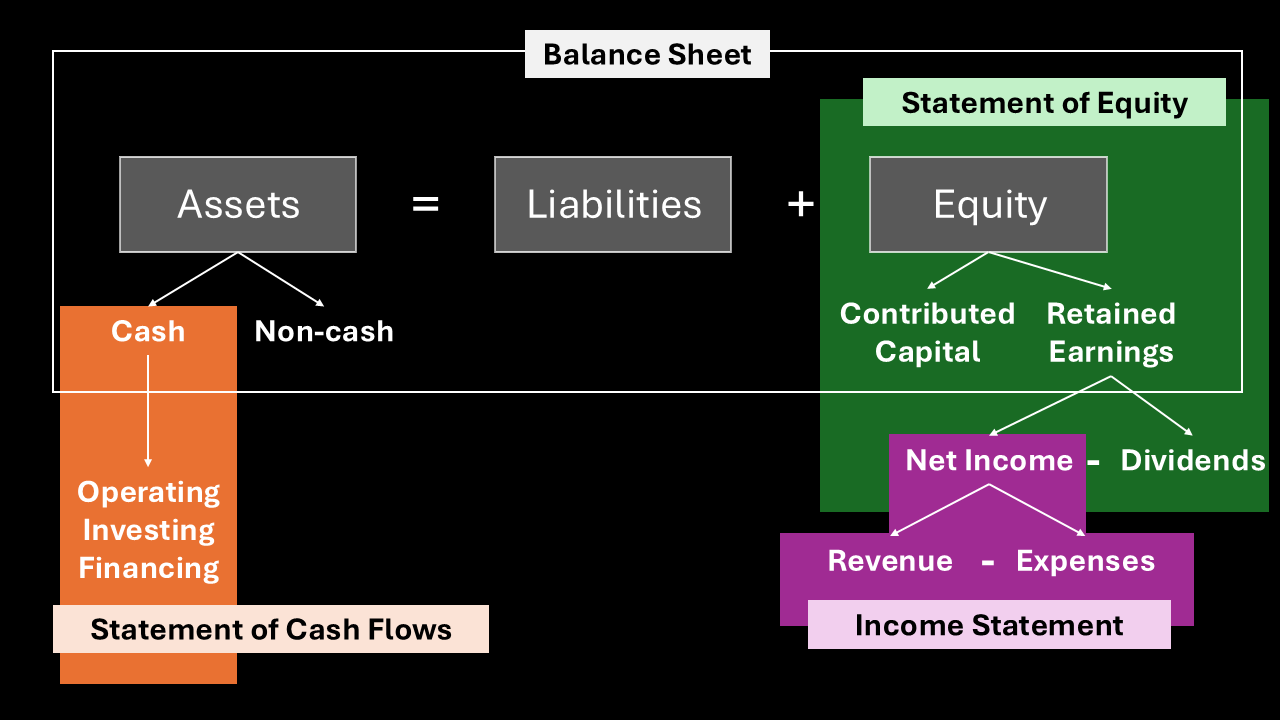

This illustration shows how the simple ROE formula expands into the three-part DuPont formula:

- Profitability: The first component is Net Profit Margin. This ratio shows how much profit a company makes for every dollar of sales.

$$\text{Net Profit Margin} = \frac{\text{Net Income}}{\text{Sales}}$$

- Asset Turnover: The second is Asset Turnover. It measures how efficiently a company uses its total assets to generate sales.

$$\text{Asset Turnover} = \frac{\text{Sales}}{\text{Total Assets}}$$

- Financial Leverage: The last is Financial Leverage. It shows the extent to which a company uses debt to finance its assets.

$$\text{Financial Leverage} = \frac{\text{Total Assets}}{\text{Total Equity}}$$

A Comprehensive Breakdown

The beauty of DuPont analysis is that when you multiply these three ratios, you get the original ROE formula:

$$ROE = \frac{\text{Net Income}}{\text{Sales}} \times \frac{\text{Sales}}{\text{Total Assets}} \times \frac{\text{Total Assets}}{\text{Total Equity}}$$

Analyzing each part reveals a company’s strengths and weaknesses. For instance, two companies can have the same ROE. But one might be driven by high net profit margin (a premium brand) and the other by high asset turnover (a discount retailer).

Key Insights from DuPont Analysis

DuPont analysis is more than a formula; it provides critical insights into a company’s financial strategy.

The Strategic Role of Financial Leverage

DuPont analysis shows that a company doesn’t need high profitability or efficiency to achieve a strong ROE. Businesses with stable, predictable cash flow can use financial leverage to boost shareholder returns.

Many companies in mature industries like retail or utilities have low profitability and asset turnover. Instead, they strategically use debt to grow their assets and amplify their ROE. This is a powerful way to create wealth for shareholders. However, it also brings the risk of higher debt payments, especially if the business environment becomes volatile.

Identifying a Company’s Growth Strategy

One of DuPont analysis’s most powerful insights is its ability to reveal a company’s growth strategy. By examining which component primarily drives a high ROE, we can classify a company’s approach:

- High-Profitability Strategy: Companies in industries with strong brands or exclusive technology focus on a high Net Profit Margin. They achieve a strong ROE by charging premium prices, maximizing profit on each sale.

- High-Efficiency Strategy: Retailers that operate on a high-volume, low-margin model thrive on high Asset Turnover. They generate a strong ROE by selling vast quantities of goods and turning their assets over quickly.

- High-Leverage Strategy: Capital-intensive businesses like those in the transportation or utility sectors use high Financial Leverage. They may have modest profitability, but they use significant debt to finance expensive assets, which amplifies shareholder returns.

Understanding these strategies helps investors move beyond simple numbers. It provides a more complete picture of a company’s financial health and business model.