Getting Started with Financial Statements: A Simple Case Study

Creating your own simple financial statements is one of the most effective methods for grasping the fundamentals of financial accounting.

This method builds on a few key principles:

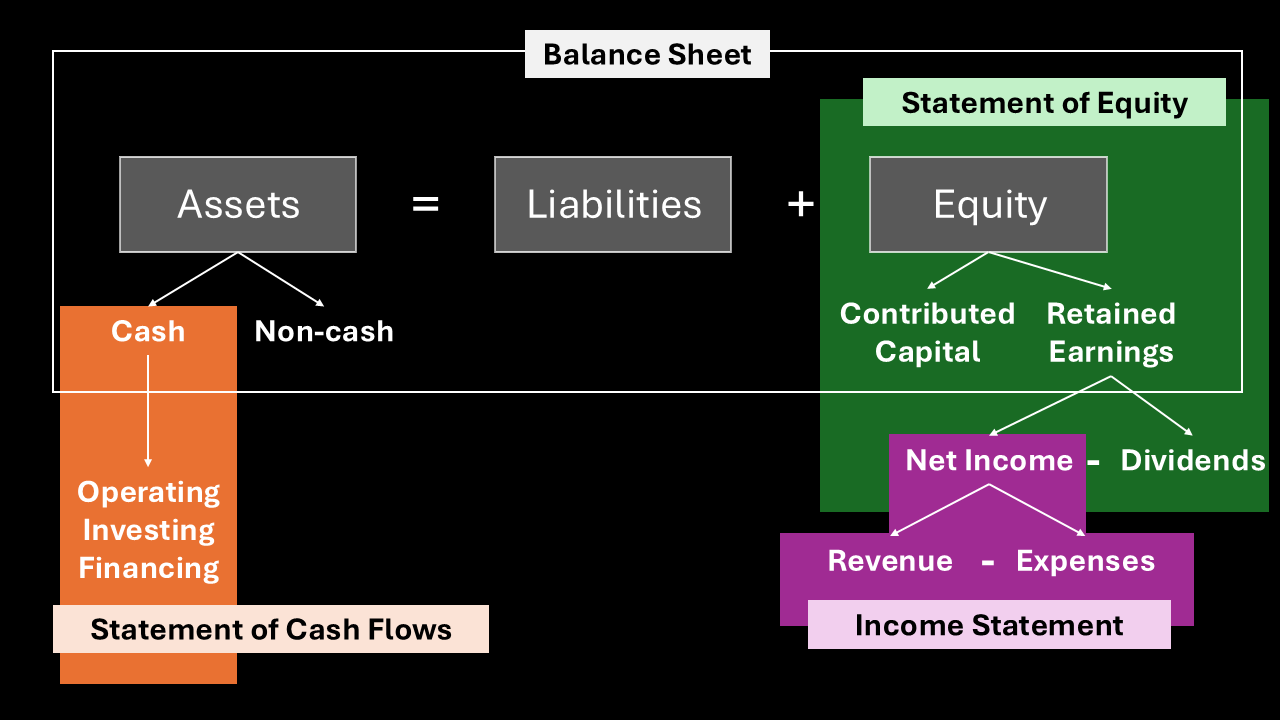

- You must always balance the balance sheet. This means your total assets must equal your total liabilities and equity. The fundamental formula is: Assets (Cash + Non Cash) = Liabilities + Contributed Capital + Earned Capital.

- The income statement shows your profitability. A simple way to check your work is to ensure your net income for a period equals the change in your earned capital. The fundamental formula is: Revenues – Expenses = Net Income

- Remember that Earned Capital = Net Income – Dividends. Therefore, in all transactions that do not involve dividends, we can treat dividends as 0, and we will assume that Earned Capital = Net Income. When there are dividends, we will treat the change in earned capital as equal to the amount of the dividends. We will use the following format for our booking. Let’s practice directly with a simple example.

Example: The Coffee Stand, Inc. (CSI)

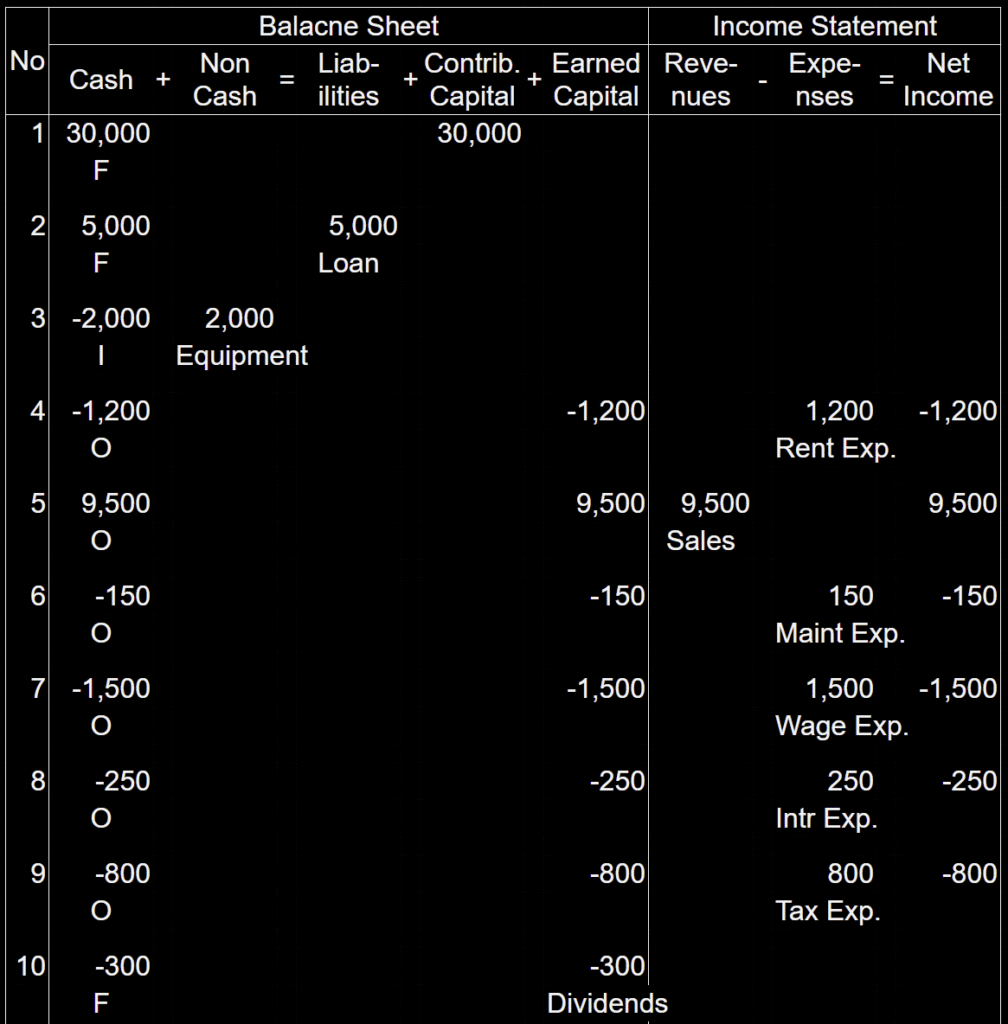

For a simple example to get you started, let’s follow a new company, The Coffee Stand, Inc. (CSI), through its first month of operations. The transactions are as follows.

1. Issued stock for $30,000 cash

- How to Book: The company receives cash (an asset) and, in return, issues stock (contributed capital). Both increase by $30,000. The “F” under cash stands for Financing because cash from issuing stock is a type of cash flow from financing activities.

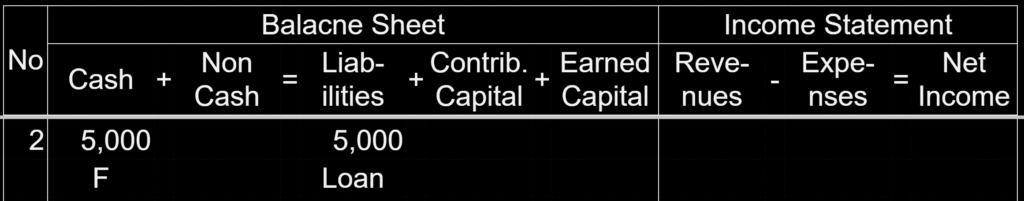

2. Took out a bank loan for $5,000

- How to Book: Cash (an asset) increases by $5,000, and at the same time, a liability (the loan) increases by $5,000.

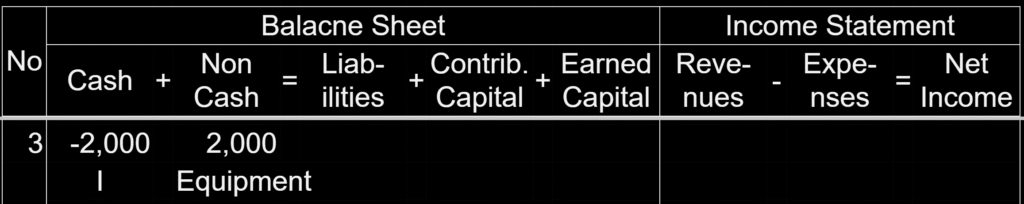

3. Purchased coffee machines and other equipment for $2,000

- How to Book: The company’s cash (asset) decreases by $2,000, while its noncash asset (equipment) increases by $2,000. One asset exchanges for another. The “I” under cash stands for Investing.

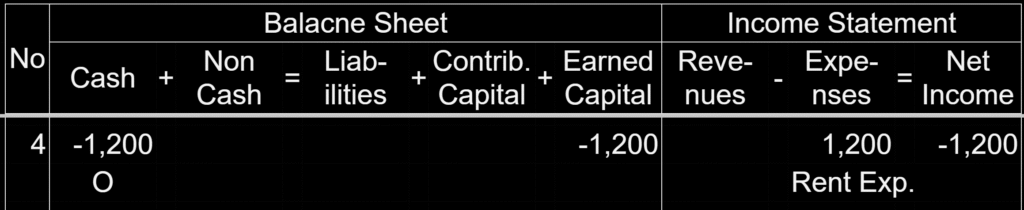

4. Paid $1,200 for rent

- How to Book: Cash (an asset) decreases by $1,200, and a corresponding expense of $1,200 is recorded. As a result, based on the formula, revenue – expense = net income, we get 0 – 1200 = -1200, so net income becomes -$1,200. We have agreed to initially treat net income and earned capital as the same, so earned capital also becomes -$1,200. The “O” under cash stands for Operating.

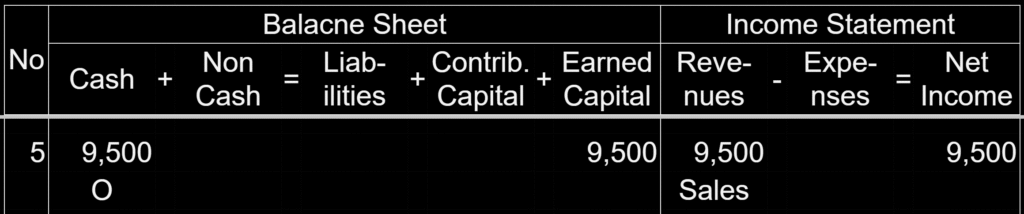

5. Sold coffee and other goods for $9,500 in cash

- How to Book: Cash (an asset) increases by $9,500, and the company earns revenue of $9,500.

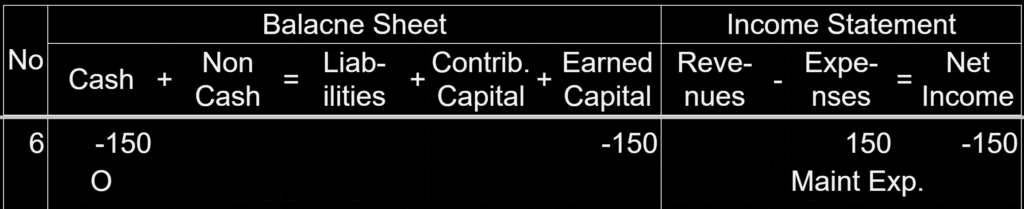

6. Paid $150 for coffee machine maintenance

- How to Book: Cash (an asset) decreases by $150, and a corresponding expense of $150 is recorded.

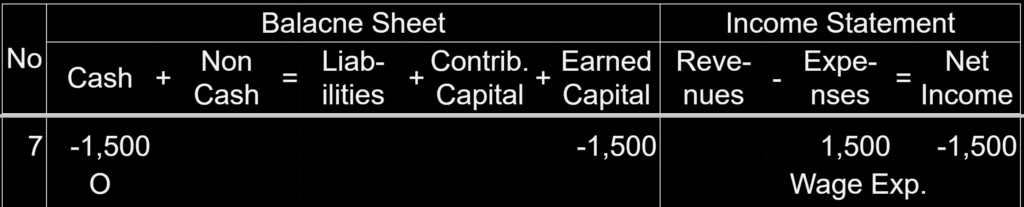

7. Paid $1,500 for employee wages

- How to Book: Cash (an asset) decreases by $1,500, and a corresponding expense of $1,500 is recorded.

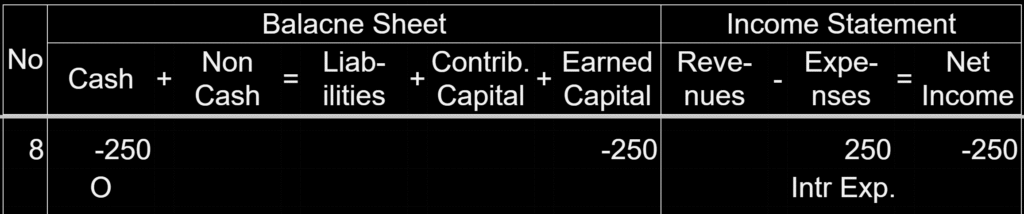

8. Paid $250 in interest on the bank loan

- How to Book: Cash (an asset) decreases by $250, and a corresponding expense of $250 is recorded.

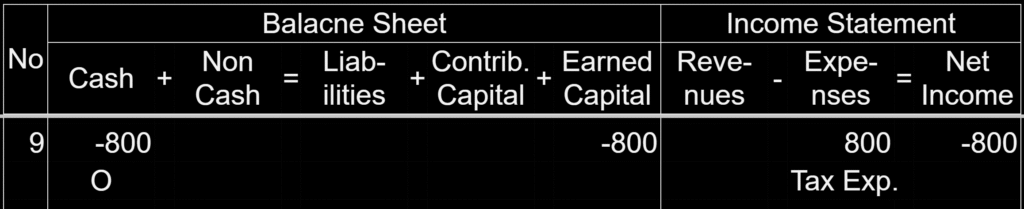

9. Paid $800 in taxes

- How to Book: Cash (an asset) decreases by $800, and a corresponding expense of $800 is recorded.

10. Paid $300 in cash dividends

- How to Book: Cash (an asset) decreases by $300, and earned capital reduces by $300.

Creating the Financial Statements

Now, let’s create the full financial statements using the table we’ve built.

Income Statement

For the month of January, 2024

- REVENUES: $9,500

- EXPENSES: $3,900

- NET INCOME: $5,600

Statement of Cash Flows

For the month of January, 2024

- OPERATING: $5,600

- INVESTING: -$2,000

- FINANCING: $34,700

- Net change in cash: $38,300

- Beginning cash: $0

- Ending cash: $38,300

Balance Sheet

January 31, 2024

ASSETS

- CASH: $38,300

- NON-CASH ASSETS: $2,000

- TOTAL ASSETS: $40,300

LIABILITIES + EQUITY

- LIABILITIES: $5,000

- EQUITY: $35,300

- LIABILITIES + EQUITY: $40,300