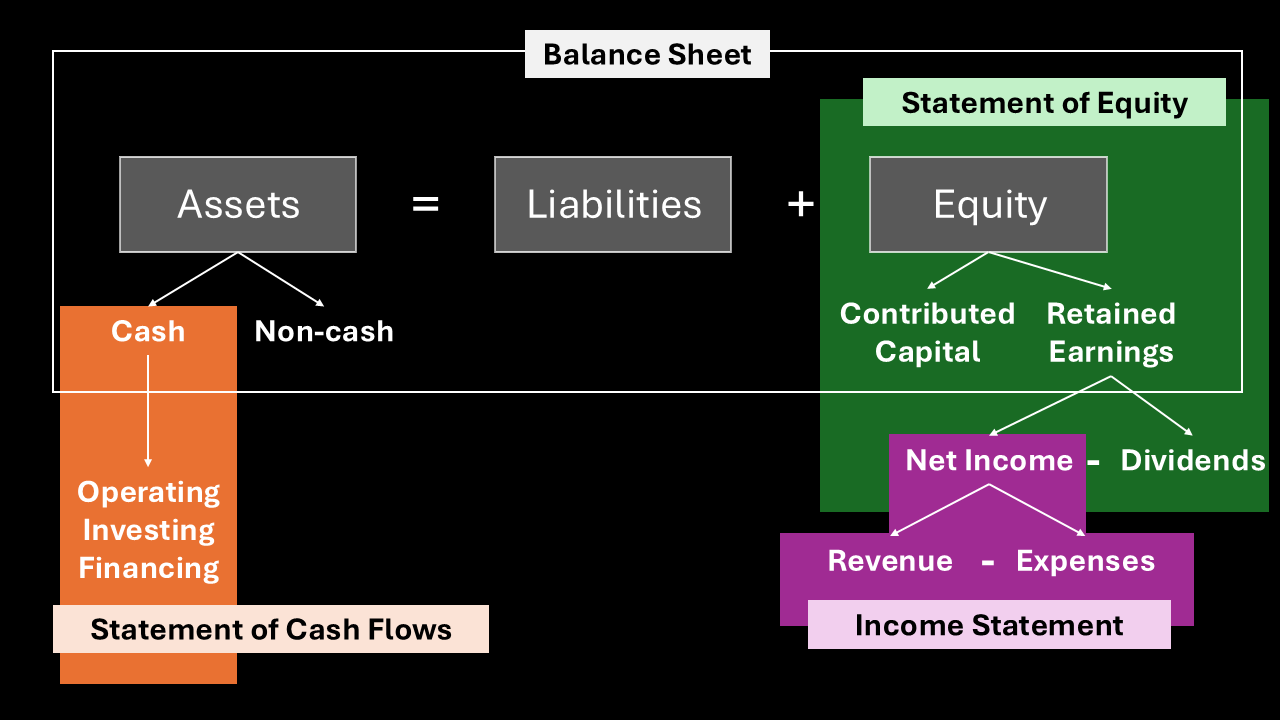

Overview of the balance sheet

In our previous post, we explored the accounting equation and the four main financial statements, including their core parts and how they relate. Today, we’ll examine a real company’s financial statements—Microsoft’s—to see these relationships in action.

Where to Find the Data

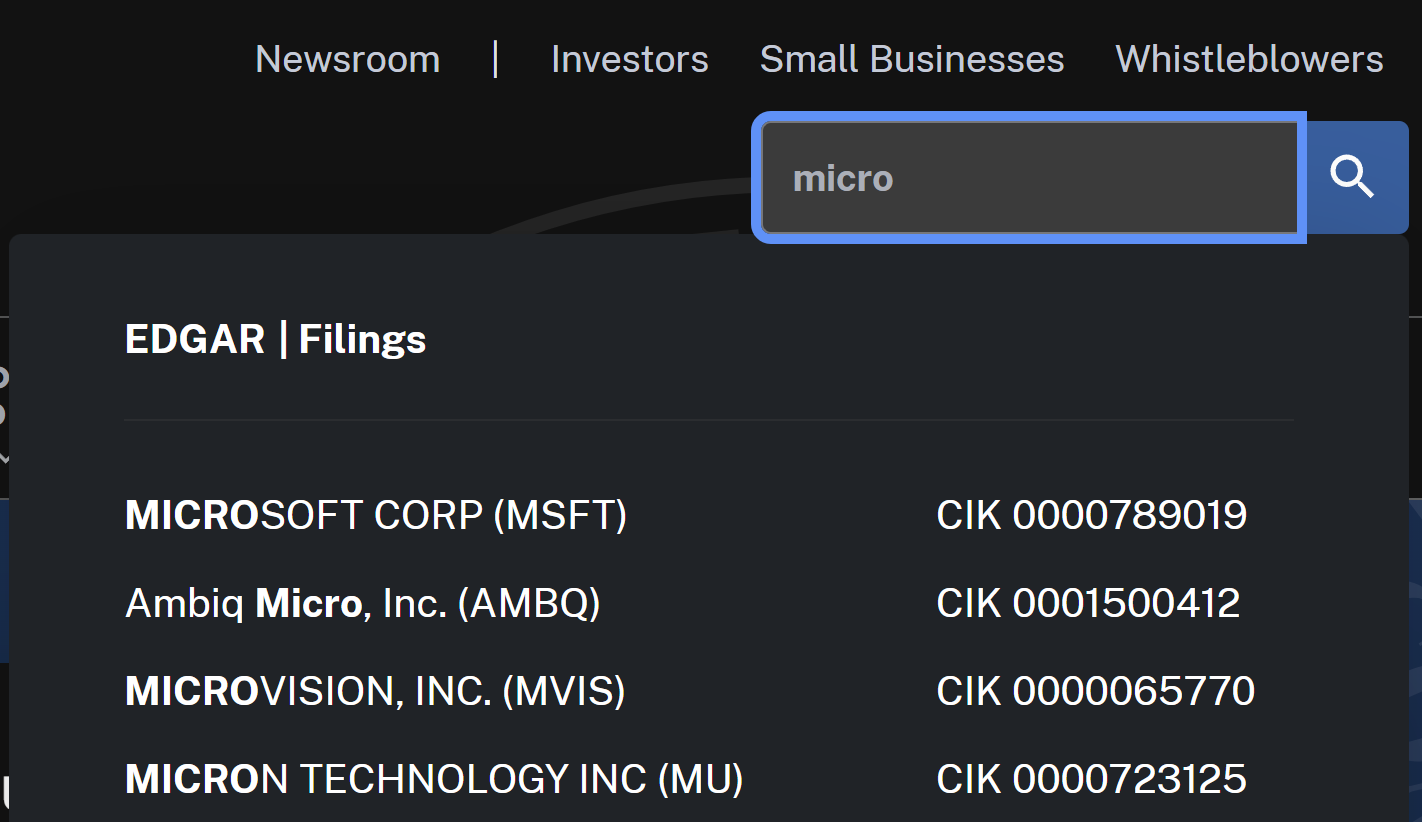

To begin, we need a reliable source for our information. The U.S. Securities and Exchange Commission (SEC) website is the official place to find financial statements from public companies. We will go to https://www.sec.gov/ and use their database to find the right documents for Microsoft.

To find the documents, use the search bar at the top right of the SEC website. Simply type “Microsoft,” and you’ll be taken to a page with various reports. Please note that sometimes the first link might not work correctly, and you may need to double-click the Microsoft link in the filing list to get to the right page.

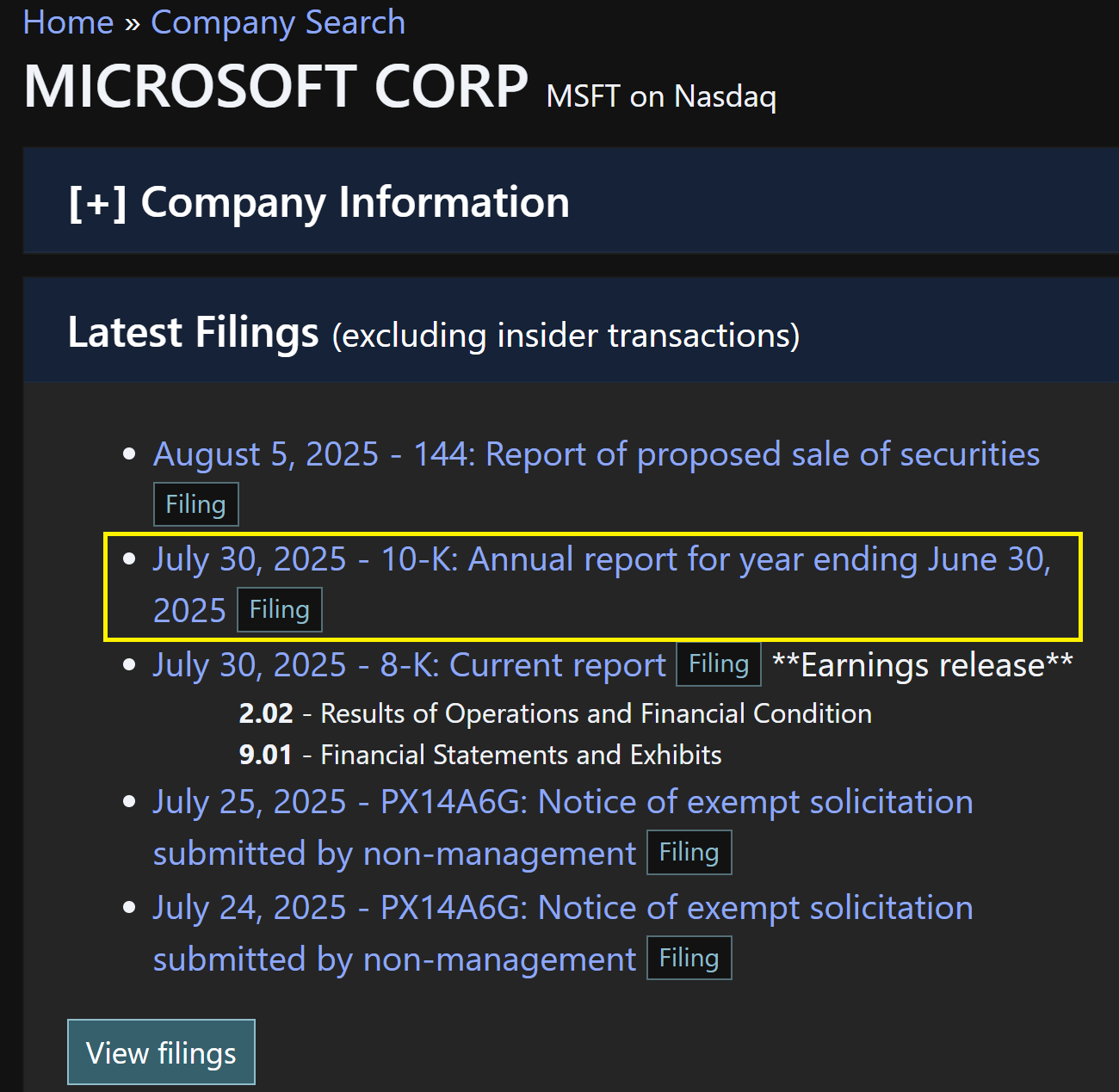

From there, you can find the most recent reports for Microsoft. We will focus on the 10-K report, which is the company’s annual financial report. This document contains the balance sheet, income statement, statement of cash flows, and statement of equity.

Understanding the Reports

The different reports on the SEC website can be confusing, but here’s a quick look at the most common ones:

- 8-K: A report used to announce major events that shareholders should know about, like a big merger or a change in leadership.

- 10-Q: A quarterly report that is like a shorter version of the 10-K, giving a snapshot of the company’s finances for a specific quarter.

- Proxy Statement: This is filed before the annual meeting to give shareholders information about the company’s leaders and any proposals they will vote on.

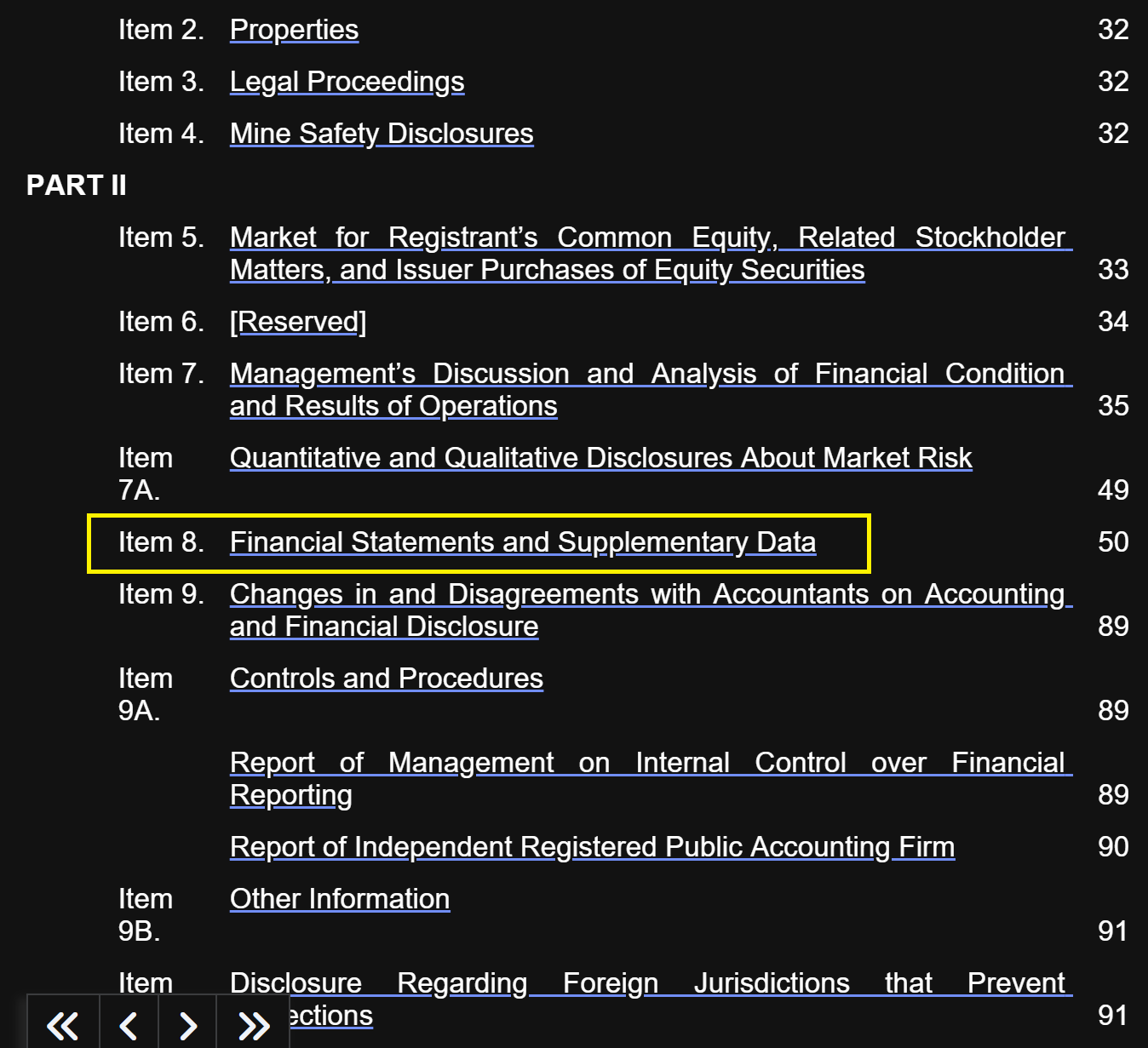

The 10-K report is very long. To quickly find the financial reports, look for the “Financial Statements and Supplementary Data” section in the table of contents. Clicking this will take you right to the key reports.

The link will likely take you to the income statement first. However, to check the accounting equation, we need the balance sheet. Just scroll down a little further to find the balance sheet.

The Accounting Equation in Action

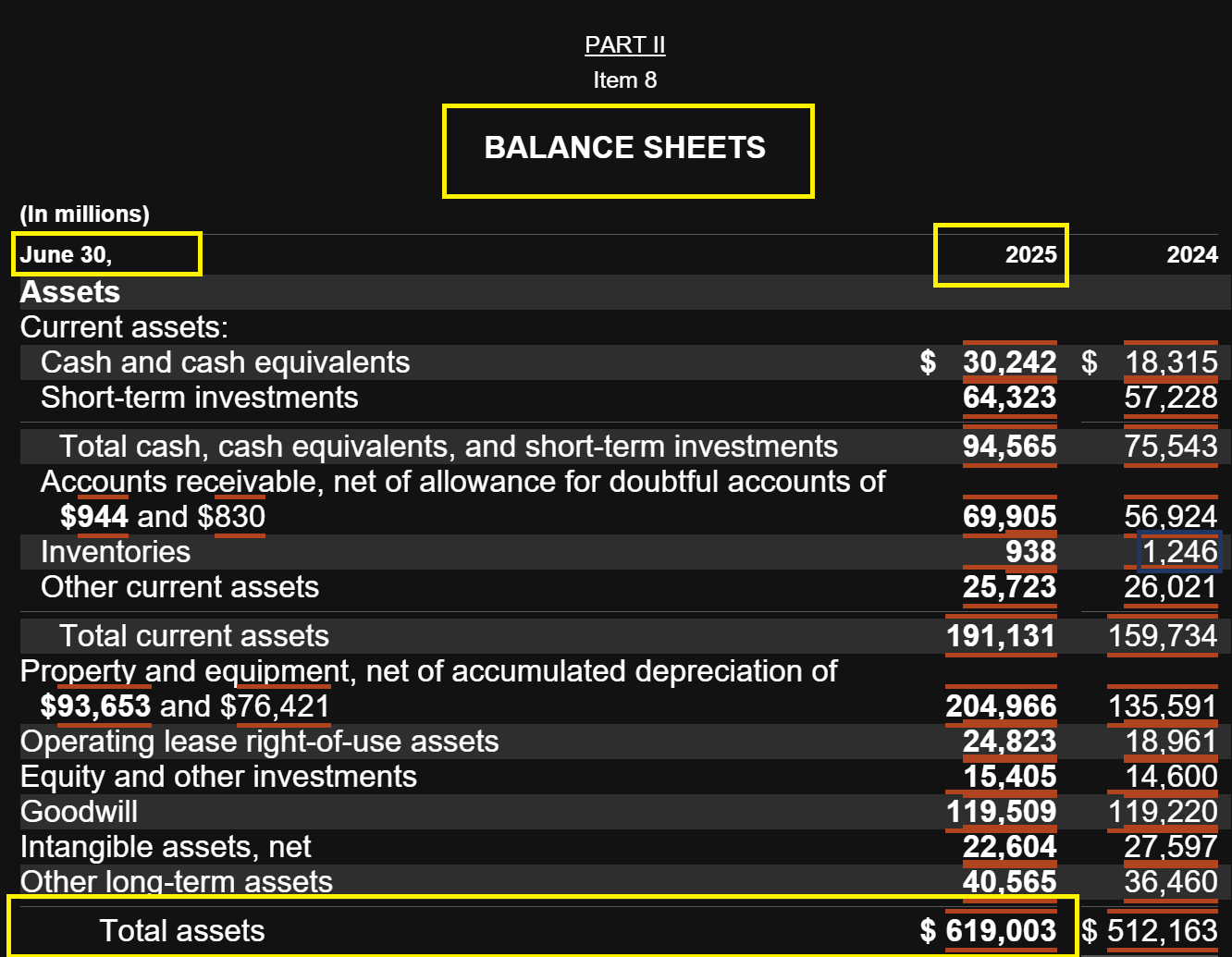

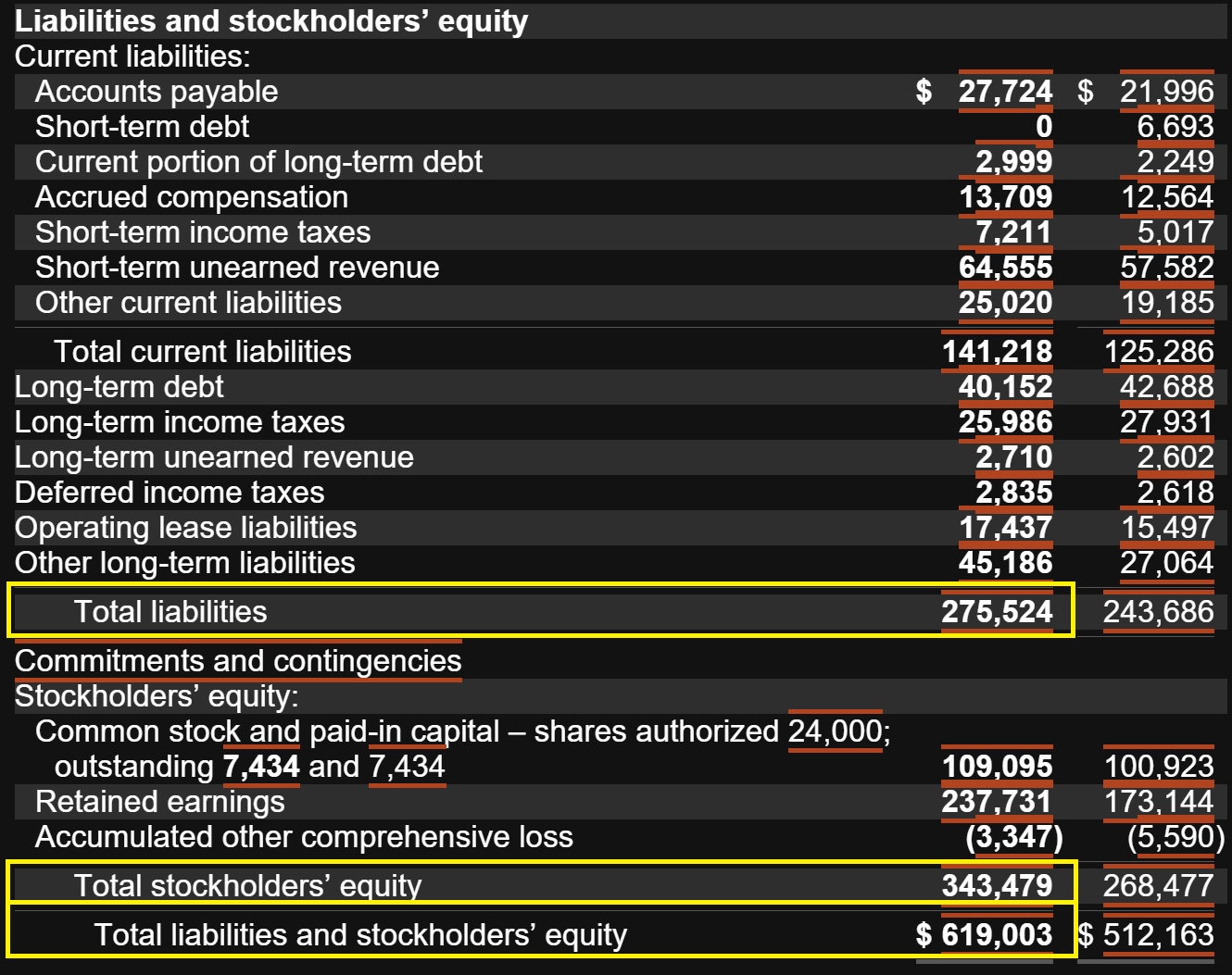

Once you’ve found the balance sheet, the first thing you can do is check if the accounting equation holds true. For instance, in Microsoft’s 2025 10-K report, the numbers as of June 30, 2025 are:

- Total Assets: $619,003 million

- Total Liabilities: $275,524 million

- Total Stockholder’s Equity: $343,479 million

When we put these numbers into the equation Assets = Liabilities + Equity, we get (in millions):

$619,003 = $275,524 + $343,479

The equation is perfectly balanced!

Breaking Down Assets and Equity

We can also break down the company’s assets into cash and non-cash items. Based on the same balance sheet, Microsoft’s cash and cash equivalents are $30,242 million. The non-cash assets can be found by subtracting the cash from the total assets:

588,761million=619,003million−30,242million

Within the total stockholders’ equity, we can see the key components:

- Contributed Capital: This represents the money shareholders invested in the company, which for Microsoft is $109,095 million.

- Retained Earnings: This is the total profit the company has kept over time, which is $237,731 million for Microsoft.

- Accumulated other comprehensive loss: This includes certain gains and losses that aren’t on the income statement. For Microsoft, this amount is ($3,347) million. For example, if a company has an investment that loses value but hasn’t been sold yet, that unrealized loss is recorded here.

Note: While simple diagrams show equity consisting of only contributed capital and retained earnings, real-world financial statements are more detailed. As we saw in Microsoft’s balance sheet, a company’s total equity is the sum of these parts and others, like the accumulated other comprehensive loss. A real balance sheet must include all parts to ensure the accounting equation stays balanced.

The U.S. Securities and Exchange Commission (SEC)