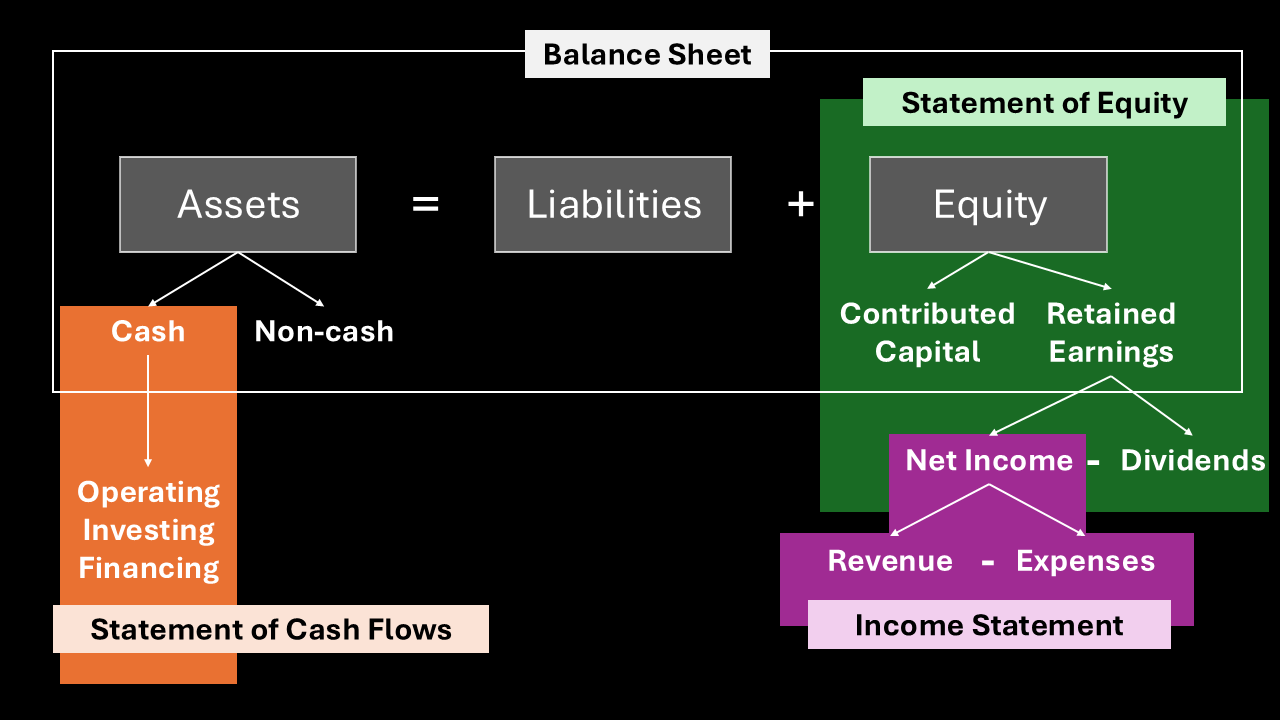

Overview of the Statement of Equity

To understand a company’s financial story, look at the Statement of Equity. While most people focus on the Income Statement and Balance Sheet, this statement bridges the two, showing you how a company’s ownership structure has changed over time.

At its core, a company’s equity consists of two main parts:

- Contributed Capital: The money shareholders have directly invested in the company.

- Retained Earnings: The cumulative profits the company has held onto over the years.

In this post, we’ll break down these two components, along with other key elements like accumulated other comprehensive loss, using a real-world example from Microsoft’s financial statements to see how they work together to form the total stockholders’ equity.

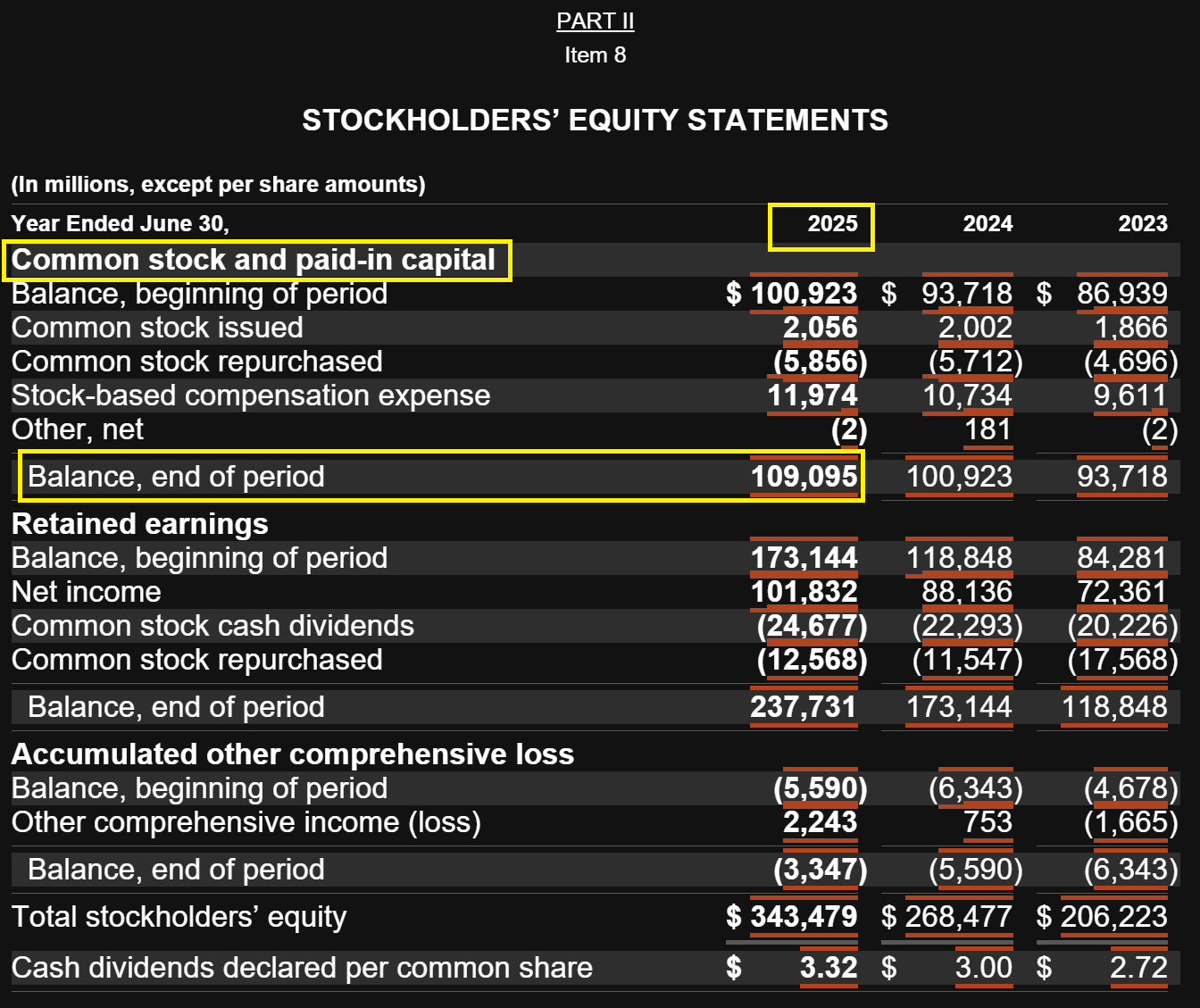

Contributed Capital

As our diagram showed, contributed capital is a core part of equity, and Microsoft’s financial statement reflects this in the “Common stock and paid-in capital” section. The value for the year ended June 30, 2025, is $109,095 million.

This section tells the story of the money that shareholders have directly invested in the company. When a company issues new shares of stock, it’s a way to raise capital from investors. The value of these new shares, along with any premiums paid above the par value, is recorded here.

Let’s look at a few key lines in this section:

- Balance, beginning of period: This is the starting value of contributed capital from the previous year.

- Common stock issued: This line shows new capital raised by selling shares, which increases contributed capital.

- Common stock repurchased: When the company buys back its own stock, this line item reduces contributed capital by the original amount the company received when it first issued the stock.

- Stock-based compensation expense: This reflects the value of stock or stock options given to employees as part of their compensation. This also increases contributed capital.

By tracking these items, we can see exactly how the total capital contributed by shareholders has changed from one year to the next.

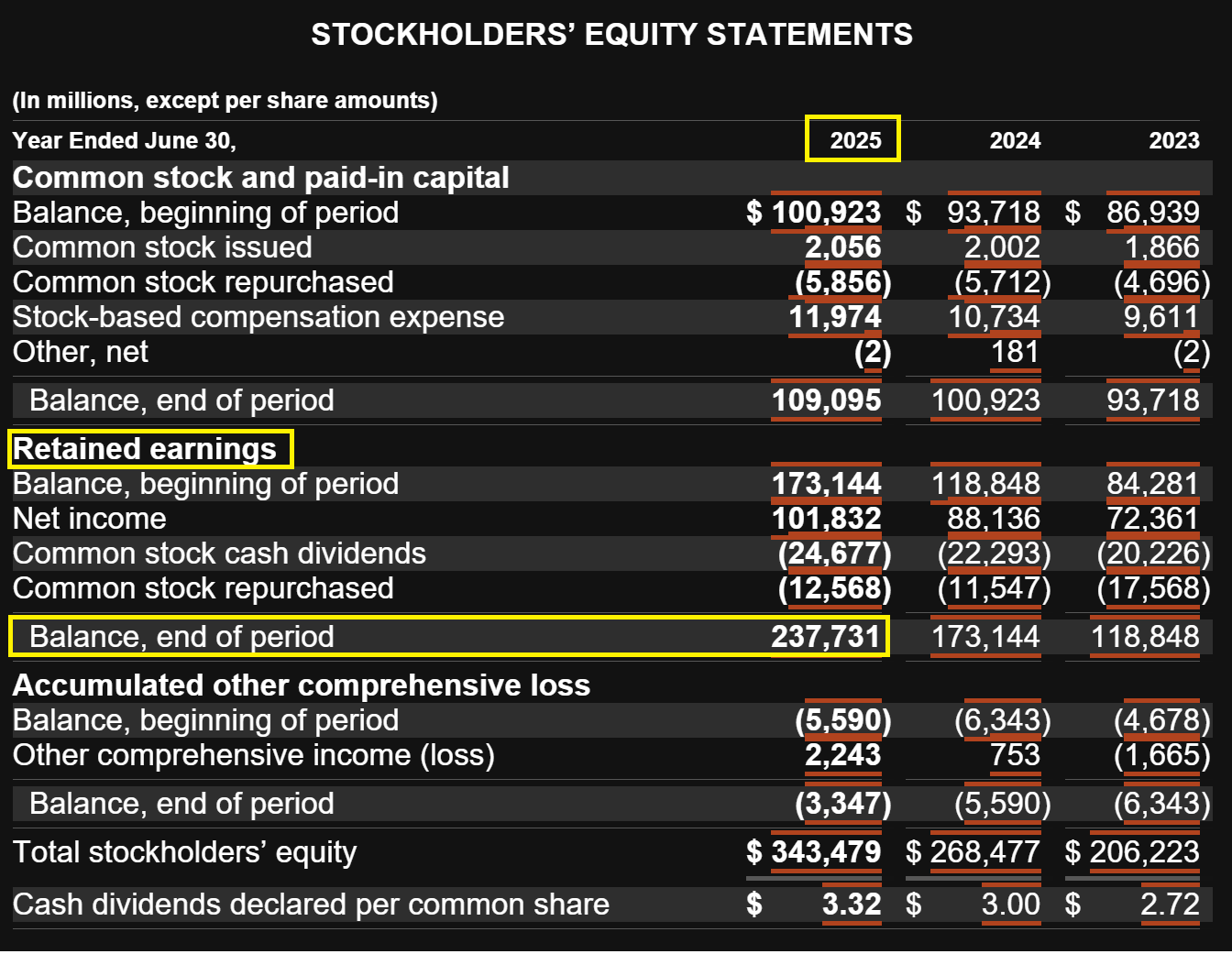

Retained Earnings

Now let’s move on to the “Retained earnings” section, with a balance of $237,731 million for Microsoft in 2025. This is arguably one of the most important components of equity.

Think of retained earnings as the company’s savings account. It represents the cumulative profits the company has generated since its inception, minus any dividends paid out to shareholders. It is a direct link between the Income Statement and the Balance Sheet.

Here’s how to read this section:

- Balance, beginning of period: This is the running total of all past retained earnings.

- Net income: This is the profit the company made in the current year, which comes directly from the bottom line of the Income Statement. This increases retained earnings.

- Common stock cash dividends: This shows the amount of cash the company distributed to its shareholders. This reduces retained earnings.

- Common stock repurchased: This line item can also appear here. When a company buys back its own shares, the amount paid above the stock’s original value is a distribution to shareholders, reducing retained earnings.

A Special Case: Stock Repurchases

By the way, why does “Common stock repurchased” appear twice? Let’s use an easy example. Imagine a company originally issued a share of stock for $10. Years later, it decides to buy that share back for $25. The company would reduce Contributed Capital by the original $10 and then reduce Retained Earnings by the remaining $15. This is why “Common stock repurchased” affects both parts of the equity story.

This also highlights an important point: while the diagram shows a simple relationship of “Retained earnings = Net income – dividends,” in reality, the equation is a little more detailed: Retained earnings = Net income – dividends – stock repurchases (another form of benefit for stockholders).

The retained earnings section is a powerful indicator of a company’s profitability and how it chooses to reward its shareholders. A growing retained earnings balance suggests the company is profitable and reinvests its profits back into the business, rather than paying them all out as dividends.

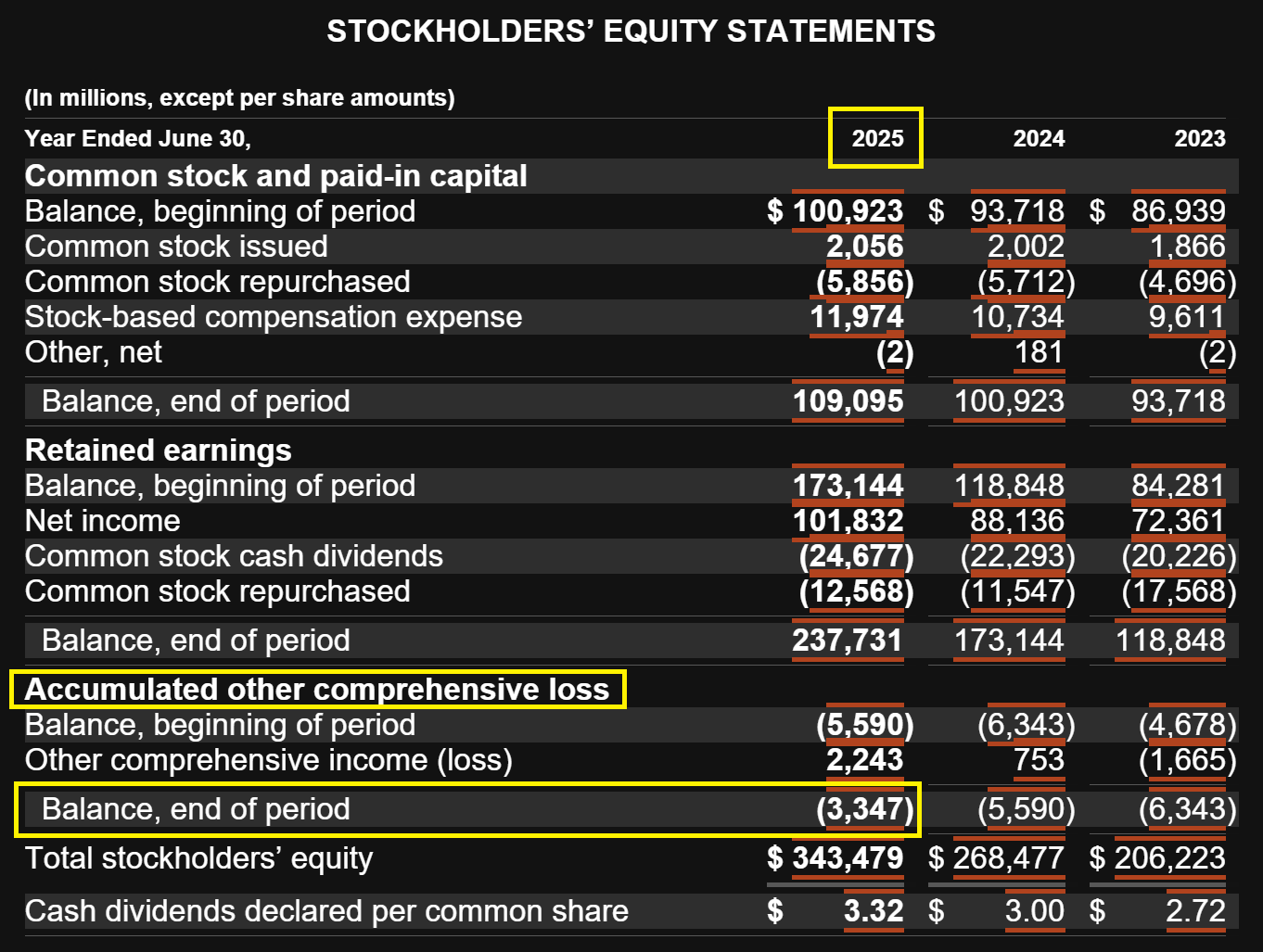

Accumulated Other Comprehensive Loss

Now, let’s look at the final piece of the puzzle: “Accumulated other comprehensive loss.” This section has a balance of -$3,347 million for Microsoft in 2025.

You can think of “Other comprehensive loss” as a special category for gains and losses that a company experiences but are not directly related to its core operations. These are things that don’t belong in the regular income statement because they are often unrealized and can be volatile.

Some common examples of these items include:

- Changes in the value of certain investments: For instance, if a company holds a foreign currency and the exchange rate changes, the unrealized gain or loss is recorded here.

- Gains or losses on certain hedging activities: These are financial tools that manage risk. The changes in their value are recorded in this section.

- Pension fund adjustments: Changes in the value of a company’s pension plan assets or liabilities.

The “Accumulated other comprehensive loss” balance is the running total of all these gains and losses over the company’s life. This section ensures the balance sheet provides a complete picture of the company’s financial health, even for items that don’t fit into the traditional net income calculation.

The Final Equation

When you add all these components together—contributed capital, retained earnings, and accumulated other comprehensive loss—you get the company’s Total stockholders’ equity. You can see this clearly in Microsoft’s statement for the year ended June 30, 2025:

Contributed Capital ($109,095 million) + Retained Earnings ($237,731 million) + Accumulated Other Comprehensive Loss (-$3,347 million) = Total Stockholders’ Equity ($343,479 million)\

Understanding this final equation gives you a powerful tool for analyzing a company’s financial health and seeing how its ownership value has been built over time.